It’s June 21, 2023. Today, I’m writing about how the pandemic and subsequent economic turmoil may have led us to a sort of “great reset.”

Maybe this is finally the “great reset”

We never really returned to a “normal” economy following the financial crisis, but maybe this is it.

Let’s start off with the fact that the Fed did not increase interest rates during its last meeting. That was the first time in 11 meetings, since the beginning of last year, that it didn’t do so. That’s why you’ve been hearing about the “rate hike pause” all week.

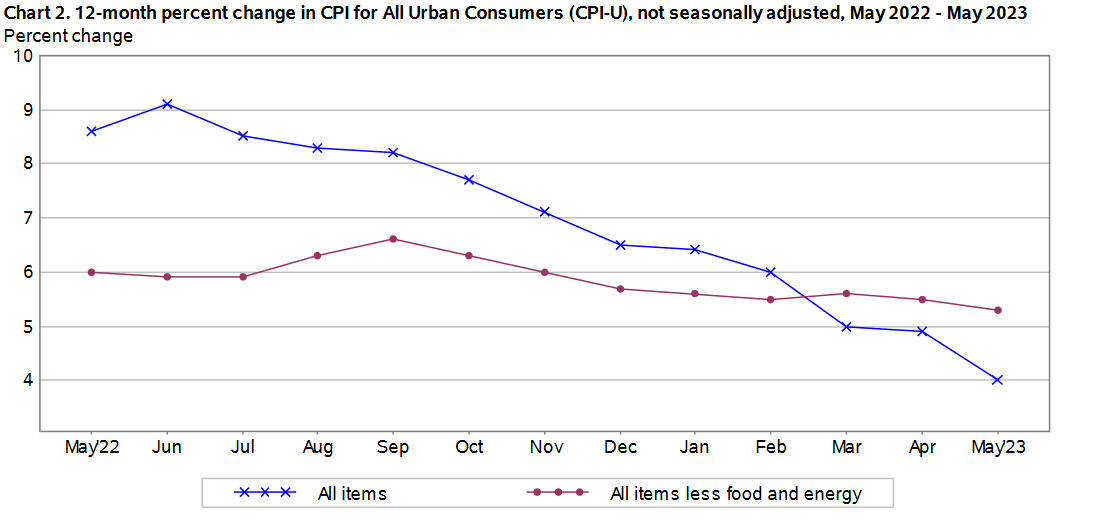

That sounds like good news, right? The Fed is, after all, seeing the intended effects of those rate hikes, which was to slow down inflation. The latest CPI report showed that inflation cooled to 4% last month. That’s down from 9%, its peak, in the summer of last year. That’s all good news — progress! And as a bonus, the jobs market is still strong, so the Fed is seeing inflation fall, without tipping the economy into a recession.

All good things.

As a result, the stock market has remained relatively high, and there’s been some buzz that “we’re back, baby.” I’ve even seen, read, and heard several people insisting that rate cuts are just around the corner. The markets would love that, as would businesses and consumers. We could get back to cheap money!

I don’t know what’s spurring that, however, as Jerome Powell said, bluntly, rate cuts are at least a couple of years away. See for yourself:

This is critical to take into consideration, if for no other reason than to temper our expectations about what’s ahead. The Fed has no reason to cut interest rates any time soon. It’s trying to cool the economy off, not stoke it. And given where the jobs numbers are, and the relatively strong metrics in other areas of the economy (most recently, perhaps, housing starts), it’d be a very strange about-face to turn around and cut rates.

But, Powell has done it before — bowing to political and corporate pressure to cut rates when there was no reason to do it. But this time, I don’t think he really has a choice: The Fed will need to keep rates up, and they even plan to raise them at least twice more this year, per its own projections.

With that all in mind, it’s got me thinking: Perhaps we’re finally seeing a sort of “great reset” in the form that we never saw following the financial crisis 15 years ago, and the subsequent Great Recession.

Here’s what I mean: The financial crisis happens, the housing bubble bursts and the economy comes apart at the seams. It’s 2009. The outgoing Bush administration/new Obama administration does all sorts of things, including a huge (for the time) stimulus package, and the Fed cuts rates to zero. And rates stayed at zero for a very, very long time. In fact, the Fed didn’t start to raise rates for six years, only starting in 2015.

When the Fed also tried to taper its quantitative easing program — which effectively just pumped money into the stock market to keep demand up, and stock values high — the markets went nuts and we witnessed the infamous “taper tantrum.” You’ll probably remember this in late 2018 and early 2019, when then-president Trump started publicly dressing down the Fed and Powell, insisting that they needed to keep the program going and cut interest rates in order to keep the stock market roaring. Powell, as noted, capitulated.

But then, the great equalizer: The pandemic. While everything about it was horrible, it may have served as a sort of equalizer when everything is considered. Yes, rates were slashed to zero, and several huge stimulus programs were introduced. But as we’ve come out the back side of the pandemic, we had to grapple with inflation — which really hadn’t been any sort of problem since the 1980s.

Cue Powell’s response: Stop quantitative easing, start quantitative tightening, and raise interest rates. Fast.

And now, as of June 2023, we’re sort of back to where we were in, say, 2007. Interest rates are ~5%, and we’re no longer pumping money into the markets. We’ve….sort of hit “reset,” and come full circle.

On top of that, we’re seeing relatively good results: Inflation is coming down, and the economy isn’t in shambles. The stock market isn’t at record highs, but it’s not far off. In fact, the S&P 500 is up 16% over the past year. It’s up more than 14% since the beginning of the year.

So, again, there’s no impetus to cut interest rates. Or do anything, really. Powell is making it clear that there’s still “a long way to go” before the Fed is comfortable with everything (inflation at 4% is still twice as high as they want it to be), but we’re more or less back at 2007 conditions, and maybe that’s a good thing.

It can be good to have interest rates more in line with historical norms. That gives us ammo for cuts if the economy does falter. We were addicted to zero rates and cheap money for more than a decade, and we paid the price eventually — while we did see a lot of growth, we also got a lot of nonsense. It’s hard to think that the crypto market could’ve grown the way it did under most other circumstances, for instance.

This is all to say that, despite all the turmoil and stress in recent years, we’re in an okay place. The next crisis may be right around the corner, but if we’ve “normalized” a bit after a decade and a half, I think that’s a positive development. Maybe we can look at real growth — rather than coke-fueled sugar highs in the market, fueled by money printing by the Fed and zero interest rates.

Again, assuming there isn’t a time bomb waiting to go off and blow it all up. Like another round of bank failures, as we saw earlier this year.

If we do get rate cuts, it may be because we’re overestimating just how effective rate increases were in lowering inflation. We’re seeing prices come down in a big way, and there are a number of reasons for it. Take eggs, for example — egg prices were up in a huge way a year ago, but now are back down to “normal” levels. That didn’t happen because interest rates were up, it had to do with avian flu killing millions of chickens and lowering supply.

Check out this egg price chart, which I was really surprised to learn exists:

The Daily, a New York Times podcast, also did a great episode on this very topic, discussing whether inflation is falling due to the Fed, or just because things are sort of…working themselves out. The answer? A bit of both.

To wrap it all up, if we take a 10,000-foot view of things as they stand, we’ve come full circle in some ways, with some economic metrics mirroring those from before the financial crisis. It’s strange — that crisis, and then the pandemic and bout of raining inflation — have brought us back to a more “normal” slate of interest rates. It was a sort of “reset” for the Fed, which otherwise would’ve needed to taper its quantitive easing and raise rates while the markets went ballistic.

Obviously, we’ve got a host of other problems to deal with, but if you can imagine someone looking at an interest rates chart in a book 50 years from now, they’d see rates ebb and flow a bit over a 15-year period. Without the wild context behind it all, it’d be hard to imagine how it all came back around.

Numbers and links

53%: The percentage of parents who say climate change is playing a role in their decisions to have kids — that includes yours truly. (CNBC)

125%: Used car loan-to-value ratios hit 125 during Q1 2023, meaning more Americans are taking out loans worth more than their cars. (Bloomberg)

Liz vs. Sherrod: Legislation has bipartisan support to claw money back from executives of failed banks. (The American Prospect)

Mean ol’ reporters: Small, local governments get mad at newspapers and take revenge in numerous ways. (The New York Times)

Hey, I like your work. You Interrested in making a cross-post ? Let me know.