Hi all, I’m taking a short break from sending the newsletter as another member of the Becker household is about to be born — hence the sporadic newsletters. I’ll probably be back in September.

With that, I wanted to do a quick survey to get a lay of the economic land as of summer 2023. It’s been a weird, wild ride over the past few years, but I’d have to say that we’re sitting in a pretty okay place. All things considered.

More good inflation news

We’re seeing the numbers we want to see.

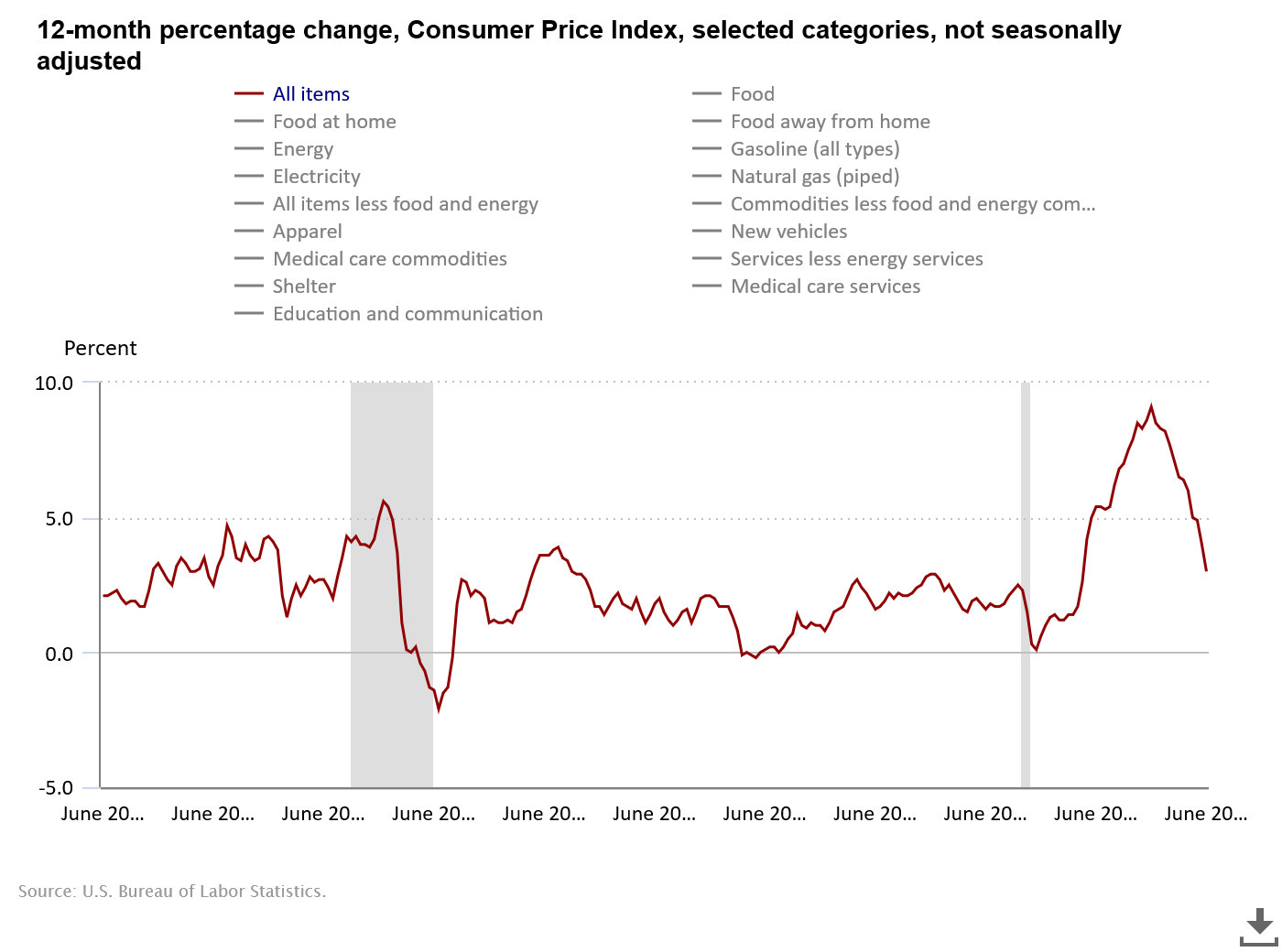

If you had told me a year ago that’d inflation would be at 3%, I’d say you were crazy. But that’s what the latest CPI report showed: Year-over-year prices increased 3% in June. That’s still above the 2% target, but way below the 9% peak seen last summer. In short, it’s excellent news.

We’re seeing the numbers we want to see. And given that inflation is, right now, the huge monkey on everyone’s back, if we keep moving in the right direction, we might be able to focus on other things.

But just to hammer at a main point again, just because inflation is cooling doesn’t mean that prices are decreasing. Prices are still increasing, just not as fast as they were. Prices naturally increase over time, and it’s probably not reasonable to expect rounds of deflation — that would cause a host of problems all on its own.

Another good thing in the latest CPI report is that wage growth is finally outpacing price increases. The Labor Department’s most recent wage summary shows that real wages grew 4.4% in June, compared to the CPI clocking in at 3.1%. That means workers are finally making up ground.

All good news.

“Bidenomics”

The president coins his term — and makes a bet.

The president and his administration went on a media blitz with a new term: “Bidenomics.” I suppose this means that they’re all comfortable enough with the state of the economy that they’re going to take credit for it.

It’s hard to say how much an administration influences the strength of the economy. The economy goes in cycles, and that influence is definitely not zero — but it’s not 100%, either. Still, I think two or so years into an administration, the president can really start to take credit for things, and we can start drawing some sort of conclusions as to how effective certain policies are, assuming they have policies.

So, we’re left with Bidenomics. I’ll be straight with you, I think that given where the country stood a few years ago — following an attempted coup d’etat, a pandemic that killed 1.1 million people (my money is on way more), and most recently, a bout of inflation unlike most people in this country have every experienced — I’m impressed. I’m supportive. I like the way things are going, generally. Obviously, there’s a lot that can be going better, but I think that the cart is behind the horse, and the train is on the track — whatever metaphor you want to use.

Again, how much of that is due to Biden’s policies? I don’t know. Some of it. But that’s the other side of the coin here: Biden is taking credit for the economy, and he’s making a bet that it’ll still be strong 15 or 16 months from now when we’re steeped in the election. If it cracks, so do his chances of reelection. I guess we’ll see what happens.

As for what Bidenomics actually is? In effect, I think it’s sort of the inverse of trickle-down economics, or “Reaganomics.”

Under those systems, which I don’t believe work very well, we essentially free up resources for the upper crust in the economy with lower interest rates and lower taxes. The idea is that if a corporation is paying lower taxes, then they’ll have more money to do other things with, like hire more employees and ramp up production.

The problem is that isn’t what happens. Companies often just engage in stock buybacks and pocket the difference.

So, Bidenomics then, is a different approach. While it’s sort of a nebulous term and idea, FiveThirtyEight recently published a podcast that goes into what “Bidenomics” actually entails — you can listen to it here, and it will help you get a better understanding of what the administration is talking about.

But here’s what Bidenomics boils down to, per that podcast:

Making smart investments in America

Educating and empowering American workers to grow the middle class

Promoting competition to lower costs and help smaller businesses

As for the actual legislation that’s been introduced to push these things forward? There’s the CHIPS Act, the Inflation Reduction Act, and the infrastructure bill — in the aggregate, they’re pushing a whole lot of resources into the economy to try and achieve these stated goals.

Will it work? I don’t know. Looks like it’s going okay for now. But again, with Bidenomics, the administration is placing its chips on the table. It’s shooting its shot. We’ll see if it pans out.

Feels over reals

Despite good economic news, people still don’t feel good about the economy.

Most signs are pointing in a positive direction. People are earning more money, price increases are slowing, and more. We should be feeling pretty good. But most people aren’t. There are still a lot of people who believe we’re actually in a recession — which makes me wonder how they’re going to feel when we actually enter one.

But if you look at consumer sentiment numbers (the chart above), consumers are feeling worse now than they were in April 2020 — how does that even make sense?

We’re also seeing this in the low confidence people have in the economy, and it’s dragging the president’s approval numbers down, if that matters. But as I’ve written before, I think there’s a lot of perception that the economy is bad that is not born out in the data.

I recently spoke with an economic analyst about this, who told me it was flummoxing, but that they think the answer is simple: Inflation.

People simply felt inflation a whole lot more than they did other economic issues. They were more worried about paying twice as much for gas than they were about finding another job. It’s squashed budgets, you can’t escape it — it all comes down to the price increases we’ve seen.

That makes sense to me. Everyone feels the effects of inflation. And since we haven’t really experienced it in any real form since the 1980s, it’s sort of a novel type of economic problem for many, if not most households. It certainly was for me.

But with things improving, it’ll be interesting to see if perceptions change. With 3.6% unemployment, CPI at 3.1%, and the stock market up almost 18% since January…it’s clear to me that we’re not anywhere near a recession. Even so, 44% of Americans apparently think we are.

Again, and as always, that’s not to say that things won’t change fast, and that the bottom could fall out. After all, the next recession is always coming.

Numbers and links

$800 billion: The value that could be lost in commercial real estate by 2030 because people are working remotely. (McKinsey Global Institute)

WTF: The Emmy nominations are out, and somehow the guy who played the king in that new Game of Thrones show isn’t listed…(The Hollywood Reporter)

Frankenstein: Former Fox News executives regret bringing to life a “disinformation machine.” (Boulderpreston.com)

GWAR visits NPR’s Tiny Desk, bringing this fake news article to life. (NPR)