It’s June 22, 2022. Here’s the rundown:

Ride the bullwhip!

A recession is coming, and I feel fine

Numbers, links, and more

Ride the bullwhip!

Deals? In this environment? It appears so!

In a world in which prices do nothing but go up, wouldn’t it be nice to find a screaming deal? Well, thanks to the confluence of numerous factors, this summer may just be your best chance to get a discount at a retail store for the first time in forever. And maybe for the last time for the foreseeable future.

Just what in tarnation is happening? Retailers are saddled with a huge surplus of inventory and need to get rid of it. From The Wall Street Journal:

Target, Walmart and Macy’s announced recently that they are starting to receive large shipments of outdoor furniture, loungewear and electronics everyone wanted, but couldn’t find, during the pandemic.

The problem for retailers—that these goods are delayed by almost two years—could be a windfall for those in the market for sweatpants or couches. Look for prices to start dropping around July 4, analysts say.

Why is this happening? Supply chains are still struggling to catch up. So, when you couldn’t find damn near anything at a store two years ago, all of that inventory is finally finding its way off of container ships and through warehouses and to your local Macy’s or whatever.

Now, there’s too much of it. It’s gotta go. And you need to buy it. For cheap!

It’s called the “bullwhip effect,” and we’re seeing it play out in action. While the supply chain disruptions are a part of it, the bullwhip effect is the result of fluctuations in demand and retailer expectations. Currently, there are several factors coming to a head, causing an overstock of certain goods.

Here’s what the analysts interviewed by The Wall Street Journal have to say about finding those surplus deals:

Don’t run to Target or Macy’s today. Sales are likely to start in July and escalate over the summer in time for back-to-school and the holidays.

Think big. Most retailers don’t have the warehouse space to hang onto oversize items like couches and patio furniture, and are likely to mark them down to create space for this season’s clothing and décor.

Don’t expect discount retailers to go lower on prices than they have already. They won’t benefit from this season’s inventory surpluses until next year.

If you’re trying to score a couch, now’s the time to do it. Otherwise, you may want to stuff your cash under the mattress for the recession that’s about to hit.

A recession is coming, and I feel fine

All signs point toward a recession. Cool, let’s get it over with.

Odds are, the economy is going to contract this quarter, and the economy will thus be in recession — which is technically defined as two-straight quarters of negative GDP growth. The Atlanta Fed, which has a GDP forecast tool, is predicting Q2 2022 GDP growth of 0%. That’s down from a roughly 2.5% estimate a month ago:

Economists are also saying that a recession is more likely than not this year, too. In fact, we may already be in one and not know it — we won’t have Q2 GDP numbers for a little while to be sure.

If you were to turn on a financial news channel or read the comments under really any article on the internet, you’d think that we just discovered that a comet was about to hit the Earth, extinguishing all life as we know it.

That’s not to discount the prospect of a recession, which can and likely will see many people lose their jobs, businesses slow down, the stock market stall, and more.

But you know what? I feel fine. In fact, I think that a recession is actually a good thing. The big problem is that we don’t have really anything we can do to combat it and jumpstart the economy again. We’ve kicked the can all the way down the road. We've emptied the clip, so to speak, and can’t lower interest rates. We’re just going to need to power through this one.

That can sound very scary, especially given that inflation is at a 40-year high, gas prices have doubled in a short amount of time, and the stock market is already down more than 20% since the beginning of the year.

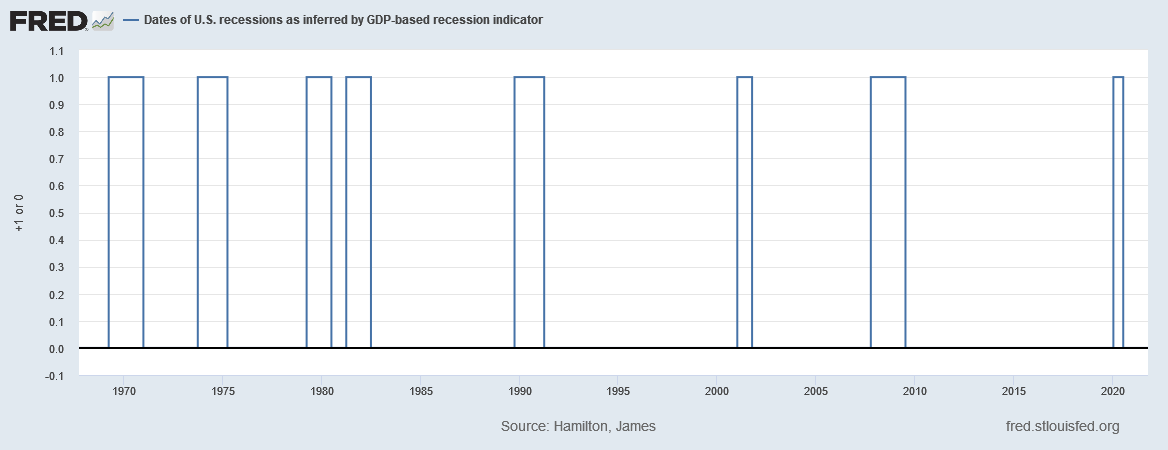

So, why am I feeling okay about all of this? For starters, recessions are normal. They’re a part of the business cycle. They don’t always need to bring about 2009-levels of pain and devastation. But they do serve as a sort of hard reset. Given the amount of money that was poured into the crypto markets, meme stocks, and more over the past few years, maybe we need a reset?

I think it’s important to remember a couple of things about recessions: First, they’re temporary. They don’t last forever. There’s pain, sure, but it’s transitory (shoutout to the Fed).

Second, and as mentioned before, they’re a normal part of the cycle. We’ve tried to avoid a prolonged recession for almost a decade and a half at this point, and the only thing that derailed the economy was the pandemic — which we threw the kitchen sink at in order to avoid a deep recession.

While the “kitchen sink” strategy may have helped us bounce back from the pandemic in relatively short order, it did get us to where we are now: Facing down another recession, and one we’ll need to navigate with fewer weapons.

If we could wind back the clock, we could’ve probably done ourselves some favors to prepare better. We could’ve raised interest rates years ago, and kept them higher. We could’ve stopped piling money into the markets to keep stock valuations high. Coulda, woulda, shoulda.

I recently spoke with a journalist and author for a story I was working on who really helped put things in perspective. There was a time in 2019, he told me, that we were cutting interest rates and there wasn’t even a whiff of a recession — so, what the hell were we doing? It’s mismanagement like that, he said, that led us to the point we’re at now.

He specifically mentioned this piece for further reading. Essentially, the Fed has dug us into a hole by capitulating to politicians and Wall Street, and there’s no easy way out.

Now, it’s time to pay the piper. And you know what? Fine. Let’s get it over with. Obviously, this is a drag. But there’s really no other way around it. I, and the rest of my avocado toast-eating generation, already experienced two once-in-a-century economic calamities in the Great Recession and the pandemic. This one should be a breeze, right?

Well, maybe not a breeze. But at this point, I’m ready to accept that I’ll be paying an interest rate on any future mortgage I may or may not take out that’s much higher than I could’ve gotten a year or two ago. I didn’t have the resources to take advantage of the massive stock market gains following the Great Recession — bummer. I (well, all of us) will need to adjust to paying more for the same products and services; gone is the era of cheap borrowing and, in some places, a relatively cheap cost of living.

I may lose business in the coming months and years. I may struggle financially. Many of us will.

What can you do? I suppose the only thing you can do is to focus on what you can control. You can control your spending. You can, to a degree, control your income. You can keep in mind that, again, everything is transitory. If you want to travel, buy a home, or start a business, you should do it. If you have the resources.

Recessions come and go. We’re about to experience the third one in 15 or so years. On average, they happen every four years or so. And they last for about 18 months. If we’re already in one, we’re already eating away at that 18 months — so, that’s sort of good news, right?

The point is, if a recession is on its way, there’s little use in fretting about it. Consider that we’re already experiencing some of the worst aspects of economic upheaval: High inflation, a bear market, and more. And we’re all still alive. We may be struggling, but we’re alive.

That said, you can take some steps to try and blunt the impact of the recession. That would include paying down debt and stockpiling cash if you can. Maybe you can make some changes to your investment portfolio, too, if applicable.

But above all, keep in mind that any recession, now or way down the line, will come and go. Just live your life. There’s no easy fix, in this case (so don’t believe anyone who promises to be able to wave a wand or flip a switch to get the economy humming again). We had our fun, and now it’s time to come back down to Earth.

Numbers, links, and more

40%: Countries with female leaders recorded 40% fewer COVID deaths than those led by men. (Scientific Reports)

65-33: The count by which employees at an Apple store in Maryland voted to form a union. (BBC)

$19 million: The winning bid to have lunch with Warren Buffet, the proceeds of which will be given to charity. (Reuters)

“The story you’re about to read is bananas, and it’s also about bananas.”: Shipping companies are really piling on and making a mint. (ProPublica)

UTBOH: I read “Under the Banner of Heaven” years ago. It recently got a TV adaptation, and some people of a particular faith aren’t happy with it. (The Atlantic)

Inside look: How does the American Economic Association Invest its money? (Conversable Economist)

SPACs go bust: SPACs aren’t handling the current economy well. (The Wall Street Journal)

Frowny Face:

Smiley Face: A police officer in the U.K. was sacked after he touched a colleague’s penis and yelled “it’s a small one!” (Manchester Evening News)

I enjoy your commentary. Well written.