It’s June 16, 2023. Today, I’m writing about a proposed student loan debt plan that sounds reasonable.

Note: This is a couple of days late. I actually had written another piece — stemming from this nutty clip. But I canned it, I didn’t think it was good enough to share with you all. Just know that there are people out there who are willing to burn the world down because they think they’re going to be rewarded after they die for doing so because somehow they’re the good guys and that absolves them of responsibility. Or something like that.

ANYWAY.

A student loan debt plan I can get behind

A group of Republicans put together a student loan debt plan that seems reasonable!

The Supreme Court is probably going to nix Biden’s student loan forgiveness plan. A while back, I wrote in this very newsletter that I didn’t really like that plan — I understand why the administration went ahead with it, and I think it’ll do some good for some people. But my main issue with it is that it doesn’t actually solve the problem of student debt.

It’s like putting a Band-Aid on a broken leg.

But imagine my surprise when a group of Republican Senators released a package of bills meant to help alleviate the student loan debt crisis. Frankly, I can’t remember the last time Republicans put forth a serious policy proposal to solve an actual issue in this country — aside from the “health care plan” they worked on for ten years, and which never materialized — so this was a welcome surprise.

An even bigger surprise: I don’t think it’s a bad approach!

On Wednesday, the Senators held a press conference to announce the package. From Bill Cassidy’s (LA) official press release, here are the five bills included in the package, and what they do:

The College Transparency Act (CTA) – Reforms the college data reporting system to ensure students and families have better information on student success and outcomes as they consider higher education institutions. Cassidy previously introduced this bill.

The Understanding the True Cost of College Act – Requires institutions of higher education to use a uniform financial aid letter with clear indications of the types and breakdown of aid included (scholarships, loans, work study, etc.) so students and their families can understand and compare their financial aid options. U.S. Senator Chuck Grassley (R-IA) previously introduced this bill.

The Informed Student Borrowing Act – Supports students in meeting their academic needs and budget when deciding to take out loans by offering clear information about the duration of their loan, their expected monthly payment, how much money they will likely make in the future after attending their school and program of choice, etc. It requires borrowers to annually receive this information through loan counseling to understand the value of their student loan. U.S. Senator Steve Daines (R-MT) introduced this bill today.

The Streamlining Accountability and Value in Education (SAVE) for Students Act – Streamlines confusing repayment options for borrowers from nine options to two to give students and families clarity as to which repayment plan best fits their needs. Additionally, the bill limits new loans to undergraduate and graduate programs where former students cannot earn more than a high school graduate or a bachelor’s degree recipient, respectively. U.S. Senator John Cornyn (R-TX) introduced this bill today.

The Graduate Opportunity and Affordable Loans (GOAL) Act – Ends inflationary Graduate PLUS loans and puts downward pressure on rising tuition costs by limiting graduate school borrowing. Additionally, it allows institutions to set lower loan limits by program to protect students from over-borrowing. U.S. Senator Tommy Tuberville (R-AL) introduced this bill today.

In short, these bills would cap lending to grad students, reform and streamline payment plans, make schools more accountable in terms of graduates’ future earnings, create standardization for disclosures from the Department of Education (outlining costs, tuition, fees, and net price before loans are given out), and expands data collection efforts.

Obviously, there are some good things here, and some that many people may not agree with. And, as always, if any of these were to actually become law, there would be some sort of unintended consequences. But I do think this is an actual effort to take on the issues at the core of the student loan issue.

That issue is that millions of young people believe they need to go to college and earn a degree to find themselves on a viable career path. Higher-education institutions know this, so they charge whatever they want for a degree, and since we want more people to earn degrees, the government is willing to lend to basically anyone. In the end, we have people paying hundreds of thousands of dollars for college degrees that could probably be earned for far, far less — if they’re needed at all in a given field.

This is difficult. Young people are looking for a viable path forward. I was. And for many years, many, if not most of them, were directly or indirectly told that college was the way to go. For me, that was community college, and then transferring to a state university. I didn’t plan that, exactly, but it turns out, that’s probably the most cost-conscious route there is for most young people.

Others went ahead and enrolled at four-year schools far from home. Honestly, if I had the chance to do that (I really didn’t put much effort in during my high school years), I probably would’ve done the same. Go far away and meet new people and learn things? Sounds great.

But at a cost of $50,000, $60,000 per year? Plus living expenses? Ouch.

That’s one of the things that I like about this package of bills. It should provide prospective students with a rundown, or menu, of what they’re getting, and how much it costs. Otherwise, it’s pretty damn hard to tell how much you’re on the hook for. I think a similar idea could be put to use in health care: “Hey, welcome to Bob’s Hospital, here’s our menu!”

And while I think some people will naturally be bummed at the thought of the government providing fewer loans to students, maybe it’s worth a shot.

Alabama Senator Tommy Tuberville, one of the Senators sponsoring the package of legislation, and who I think very little of, had this to say: “The last 35 years have shown that a government blank check to the universities has made problems worse.”

I think he’s wrong about just about everything, but I think he’s right about this. It’s effectively the same issue that led to the housing bubble and crisis in 2008 and 2009. Sure, there are some differences, but when you create unlimited demand for a product (in this case, education), why wouldn’t the suppliers continue to raise prices every year? Consumers may bitch about it, but they’ll never stop buying!

I know that Biden took a shot at this. But it isn’t enough. And I don’t think that handing out loans to every 18-year-old who wants to go to whatever school, when there are other viable options (vocational schools! trade schools! apprenticeships!) out there.

Let’s look at the numbers: The federal government is set to loan out roughly $1 trillion in student loans in the next decade or so. I’m not opposed to the government loaning money to students or businesses — in fact, I think that’s a pretty darn good use of public funds, all things considered. But what we’ve been doing clearly isn’t working in some respects, so maybe it’s time to try a new approach.

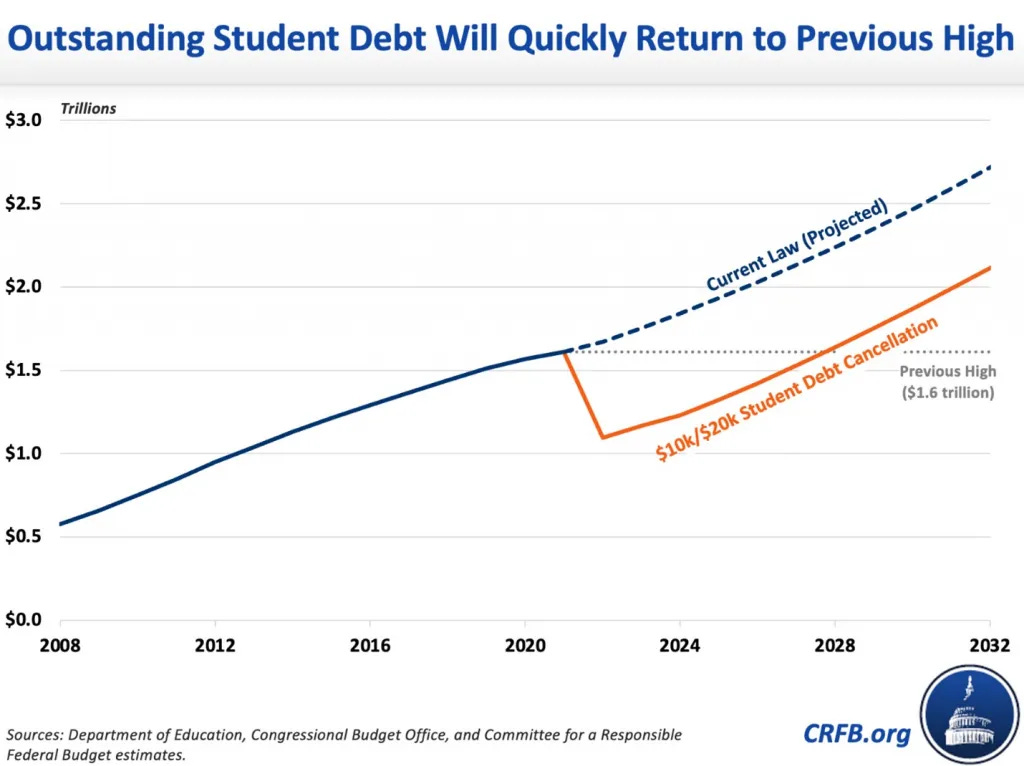

And then there’s the fact that even if Biden’s loan cancellation plan survives a Supreme Court challenge (I’m betting it doesn’t), we’ll be back in the same position in terms of total student loan debt in the U.S. ($1.6 trillion) by 2028.

Like I said, it’s a Band-Aid. It’s not going to solve the problem. It’s not enough.

Above all, we’re talking about schools. Educational institutions. These are designed to be places for higher learning, and I really, really dislike how they’ve turned into money-making engines for both the private and public sectors. I was, as I’m sure many of you were, on the receiving end of many lectures from older people who went to school for a few hundred or thousand dollars, and paid it all off by working part-time during the summer. Yes, that was before these systems were hijacked and turned into revenue generators.

Don’t even get me started on the business of college sports, too. I used to like college sports, like football and basketball, just as millions of other people do. But as I get older, the whole concept becomes stranger and stranger to me — the schools and coaches and sponsors make piles of cash but can’t fathom paying the people actually doing the work — the students? But again, another topic for another day.

I’ll end with this: I’m surprised to see a real, live policy idea from the Republican Party. I’m surprised that I don’t completely disagree with it. I’ll be VERY surprised if it actually goes anywhere. But I do think the higher-ed system needs a jolt, and I think it can start with smarter policy about how we’re funding people’s educations.

These bills probably won’t get any traction and become law. But maybe they can germinate some ideas and get us thinking differently. Here’s hoping!

Numbers and links

14: The age of a new SpaceX employee who just graduated from Santa Clara University. (The Mercury News)

The Kaczynski moment: The Unabomber, who recently died, is inspiring a new generation of crazies. (New York Magazine)

Shhhh: “Quiet luxury” is having a moment, even as everybody is broke. (CNBC)

“Nobody’s Perfect”: This golf guy thinks everybody should get over 9/11 because…Saudi Arabia pays him a lot, I suppose. (Fox News)