Dancing on the debt ceiling

It’s February 1, 2023. Here’s the rundown:

The SEC makes a move against crypto

Debt ceiling: What you need to know

Numbers and links

The SEC makes a move against crypto

I’m sharing a story I worked on for a long time.

I wanted to share a story that I worked on for several months that I finally finished and was published this week. It’s about the potential fallout of the SEC filing insider trading charges against a few guys in the crypto market — if the SEC is successful, it could give the agency regulatory power over crypto by default.

If you didn’t know, crypto is not (really) regulated right now — so, this could be a big deal.

The story was published on Fast Company, and I’ll put a snippet below. I’d appreciate it if you clicked through and gave it a read, though. It was a slog, and I think it’s kind of interesting — albeit fairly complicated. And since I hate just about everything I’ve ever written, I do like this one, and wanted to share.

Thanks!

The crypto market seemingly had its comeuppance during 2022, as a prolonged crypto winter crushed asset values, and a number of large exchanges and crypto platforms went kaput, including the collapse of platforms like Celsius and FTX. But perhaps the most consequential change in the crypto industry somewhat flew under the radar: Regulators went on the offensive.

While the government has mostly taken a blithe approach to crypto since the advent of Bitcoin more than a decade ago, the U.S. Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) shifted their stance in a big way in 2022. That came to a head in June when the DOJ filed insider-trading charges against Nathaniel Chastain, a former executive at NFT marketplace OpenSea. The suit alleges that Chastain was caught “using confidential information about what NFTs were going to be featured on OpenSea’s homepage for his personal financial gain.”

A month later, in July, the SEC likewise filed a lawsuit against three people—Ishan Wahi, a former Coinbase employee, his brother Nikhil Wahi, and their friend Sameer Ramani—accusing them of insider trading. The lawsuit alleged that while working at Coinbase, Ishan Wahi tipped off his brother and Ramani with confidential listing announcements over 8 months, which the two used to realize roughly $1.5 million in profits. The DOJ filed parallel charges, and one of the men pled guilty to one count of conspiracy to commit wire fraud in September.

While the lawsuits may seem rather routine to an outside observer, the SEC’s case, specifically, could have a profound and even crippling effect on a $1 trillion global crypto market.

Read the full story at Fast Company.

Debt ceiling stuff: What you should know

Like clockwork, it’s time to worry about the debt ceiling again. Here’s what you need to know.

If you haven’t already, you’re going to be hearing a lot about a crisis involving the debt ceiling. Yes, you’ve heard about it before, and yes, we’re dealing with pretty much the same crisis yet again.

With that, I thought it would be worth unpacking. Many of you probably know this, more or less, but I have had some people ask me about it, so we’ll do a quick rundown.

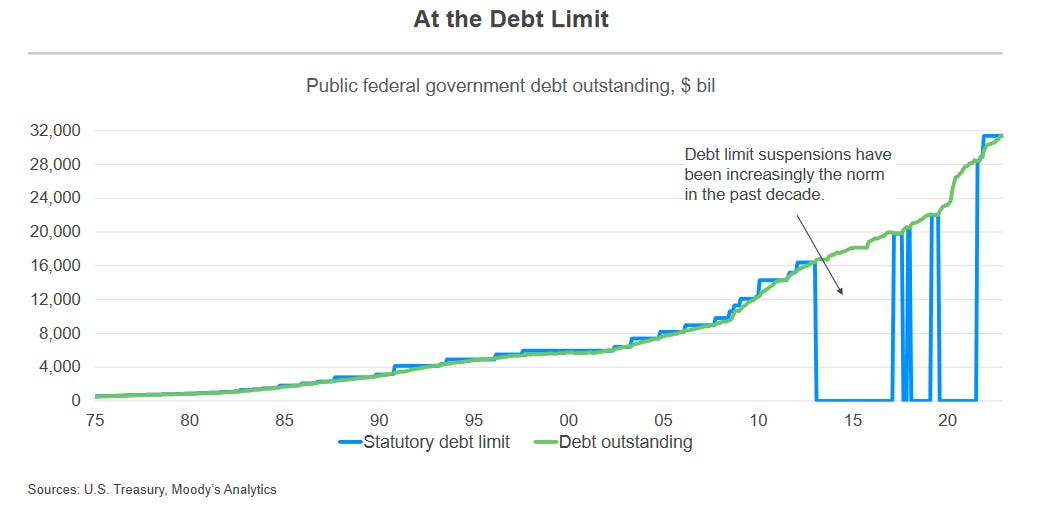

First up, the debt ceiling is like a credit card limit — the country can only borrow up to a certain limit. But since we keep running deficits (we spend more money than we bring in in tax revenue), we need to borrow money to keep things running. The current national debt is $31.5 trillion and counting. The only way to stop going into debt would be to either stop spending so much or to bring in more money in tax revenue.

Good luck trying to take services away from somebody, or likewise, tell them their taxes are going up — this is why we don’t aim to actually fix the problem. The solutions are unpopular, and nobody wants to do unpopular things.

As for the debt ceiling, we’ve already passed the debt limit passed by Congress, which was $31.4 trillion. So, what we need to do now is to make the limit even higher, so that we can keep borrowing money. If we don’t, we can’t pay our current debts, and things could get really messy.

Analysts say that not raising the debt ceiling could double unemployment, lead to millions of lost jobs, and a whole host of other economic damage. This is a problem we keep encountering, too. We’ve raised the debt ceiling 89 times since 1959.

So, while it’s not really a good thing that we’re going further into debt as a nation, raising the debt ceiling isn’t really a big deal. It’s more or less become a political fight in recent years, used to stall things and generate headlines.

That’s what we’re dealing with now, and why you’re going to be hearing about the debt ceiling fight.

Congress has the power to either raise or suspend the debt ceiling. They last did so at the end of 2021, when they raised it to $31.4 trillion. We’re currently past that, but there are some stopgaps the government uses to cover things for a while — things really hit the fan later this year.

But we have a new government, and a new House of Representatives, which has some…colorful characters who are…willing to let the country take a whole lot of damage. The idea, it seems, is to get into a pissing match with the Biden administration, which needs the debt ceiling raised, by refusing to raise it — then, when or if the economy takes a hit, play the blame game.

The problem is that there will be a whole lot of collateral damage to you, me, and everyone else while the pissing match and blame game commences. And defaulting would be a first in American history.

There’s a lot more to potentially discuss on the topic — why and how the debt has grown so much over the past 40 years, what to do about it, etc. — but I wanted to run through this as it’s likely going to dominate public discourse for the next several months, barring some sort of legislative deal coming to fruition in the near future.

And if you’re worried about it, you can look to the markets as a signal of what’s ahead. From Michael Batnick:

“What this could do to the economy and the stock market is anybody’s guess, but there is probably less cause for alarm than you might think.

That’s because the market does a good job of pricing in risk events that have a date associated with them. Risk usually happens when investors get blindsided by news they did not expect or news that is worse than expected….The government has until June to figure its shit out. Meanwhile, January just had a heck of a run. One doesn’t have a whole lot to do with the other, but there you have it.

I respect risk. I don’t mean to trivialize this. But with all that investors have to worry about right now, the debt ceiling is very far down my list.”

Numbers, links, and more

1 in 8: The number of Americans over age 50 who show signs of food addiction. (University of Michigan)

-4%: The growth in home prices nationwide between June and October. (FRED)

$400: The expected retail price of the shoes resulting from Nike’s collaboration with Tiffany & Co. (Sole Retriever)

Then, they came for The Little Gym: Private equity is trying to get its meathooks into toddler gyms. (The New York Times)

Russia’s prisoner army: Mercenaries fighting for Russia are apparently a whole bunch of convicts, as evidenced by a growing cemetery. (Reuters)

Hmm: The world’s third-richest man may be pulling the largest con in corporate history. (Hindenburg Research)