"Favre" Be It From Me to Judge Someone

It’s September 28, 2022. Here’s the rundown:

Favre Be It From Me to Judge Someone…

In fighting inflation, the U.K. goes its own way

Numbers and links

Brett Favre: The reverse Robin Hood?

The Hall-of-Fame quarterback got caught stealing from the poor to give to the well-off.

Some people just can’t take their fortunes and reputations and walk off into the sunset. Elon Musk, Donald Trump, Rudy Giuliani — there are many examples of people who have it made, but simply can’t take their money and their good names and go sit on a beach somewhere.

But they just. Can’t. Do it.

The most recent example: Brett Favre, one of the greatest quarterbacks in NFL history, and now, a guy who’s pilfering welfare money for no good damn reason.

Here’s the story to get you caught up.

Favre apparently worked with the governor of Mississippi, Phil Bryan, and a non-profit leader named Nancy New to hijack roughly $8 million from the state and redirect it to a volleyball stadium at the University of Southern Mississippi. He was also paid millions of dollars to make speeches that he never made (he paid the money back after getting caught, though). He also tried to get state money to build an indoor practice facility for USM’s football team, too.

In all, Brett Favre has found himself at the center of Mississippi’s largest public corruption case ever. The state has filed a lawsuit to claw back $20 million from him, which it could desperately use, as Mississippi is one of the poorest states in the country.

The best part? He knew what he was doing, and did it anyway. And he didn’t want anyone to find out. From The New York Times:

As he became further enmeshed in a scheme that diverted federal welfare money to build a volleyball stadium that cost more than $5 million at the University of Southern Mississippi, the former football star Brett Favre texted a question to the head of a nonprofit doling out funds meant to go to welfare recipients in the nation’s poorest state.

“If you were to pay me,” he wrote in 2017 of a $1.1 million proposal for promotional efforts that would actually be funneled toward building the stadium, “is there any way the media could find out where it came from and how much?”

Yeah, you wouldn’t want the media to find out. That might make you look like a scummy jackass or something — “Favre” be it from me to judge him, though.

The question that this raises — and it’s not merely a result of Favre’s behavior, but many other wealthy people who generally hold the admiration of the public — is why can’t you leave well enough alone? Favre has millions of dollars, not just from playing professional football, but from doing commercials and other things, too. Presumably, he could’ve paid for the things he wanted himself, won over even more fans, and would’ve likely seen no impact whatsoever on his daily life.

But instead, he chose a different path. He blew up his reputation and is facing the real possibility of losing a lot of money in the coming lawsuits. Again, this isn’t strictly limited to Favre. It’s been frequent in the political arena in recent years, with guys like Bill Barr or Rudy Giuliani who were, by and large, respected members of the political elite until they chose…a different path.

Surely, the guy who did all of those rugged ads for Wranglers for several years could bootstrap his way through a fundraising campaign for some sports facilities? I suppose prying open the public coffers was easier, though.

Evidently, this whole story gives us a bit more insight into what goes through the minds of the rich and famous: That they can get away with pretty much anything, so long as the media never finds out. We see it again and again.

I’m disappointed, Brett.

The U.K. takes a different approach to fighting inflation

Inflation in the U.K. is higher than it is in the U.S., but the U.K. government is taking a different approach.

Say what you will about Jerome Powell and the Federal Reserve’s approach to fighting inflation, but at least they’re pointing their weapons in the right direction. Across the pond, the U.K. government is doing…something else.

While the U.S. is dealing with high inflation, the U.K. and most of Europe has it even worse, as they’re simultaneously grappling with a war in Ukraine, and an energy crisis. In the U.K., the most recent inflation numbers tallied 9.9%.

Like the U.S., there are some weapons for dealing with inflation. Namely, the central bank can raise interest rates, increase borrowing costs, and tamper demand for goods and services. That’s what the Fed is doing in the U.S.

We can also raise taxes, further increasing costs on businesses and households, lowering spending ability, and thus demand for goods and services. This would require Congress to act in the U.S., so we’re not doing it.

In the U.K., though, they’re taking a different approach behind new Prime Minister Liz Truss: Cutting taxes.

While that may sound great under normal circumstances, a tax cut effectively frees up more cash in the hands of consumers and businesses. That’s good if you want the economy to grow, but again, it can increase demand for goods and services, and thus, increase prices.

So, it’s something of a “fight fire with fire” strategy that seems bizarre, given the circumstances.

You could say we’re doing a bit of that in the U.S., too. The most obvious example is President Biden’s student loan forgiveness program, which will cost something like $400 billion over 30 years. But more immediately, it effectively gives tens of millions of people “extra” money to spend that they had originally set aside to pay their loans.

Again, not great if you’re trying to lower demand.

But back to the U.K. — Truss is trying to balance slowing economic growth with fighting inflation. It’s the same balancing act that Fed chair Jerome Powell is trying to pull off: Lower prices, but avoid a recession. He’ll probably fail, but in the U.S., it seems that we’ve more or less accepted that a recession is either here or on the way.

However, I would say that the Fed is currently doing the right thing, as painful (and late) as it might be. Relative to Europe, the U.S. economy is showing signs of strength, and inflation isn’t quite as bad. Obviously, Europe is also dealing with some issues that Americans don’t need to worry about, most notably, the war in Ukraine, and the associated energy crisis.

While many Americans were blowing capillaries about gas prices a couple of months ago, many Europeans were wondering how in the hell they were going to keep their homes warm this winter.

Essentially, though, we’re seeing two parts of the U.K. government — the Bank of England and the Prime Minister — play tug-of-war. They’re raising rates and cutting taxes. They’re trying to have their cake and eat it too.

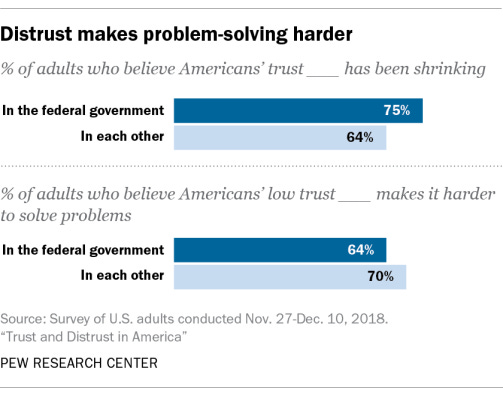

Again, it’s not like we’re not doing a bit of this in the U.S. But I bring it up because we’re already dealing with a significant portion of the population that either doesn’t have faith in our institutions and leaders or simply doesn’t trust them. When you see leaders and policymakers playing tug-of-war with your economy like this, it’s hard to blame them for their fractured confidence.

Another element worth mentioning here is that U.K.’s Prime Minister is essentially trying to convince citizens that another round of “trickle down” tax cuts will work — you know, cut taxes for businesses and wealthy households, and the money will “trickle down” and the economy will expand. It doesn’t work, as we’ve seen over the past few decades of trying here in the U.S.

In the end, Truss is essentially making a big bet that tax cuts will lift the U.K.’s economy as Europe heads for a recession. With Truss’ central bank subscribing to an inverse strategy, it’s hard to see how this will pan out. And while I know nothing about the U.K.’s economy or policies, I can only imagine what that would look like in the U.S., and all of the spicy Facebook memes a diametrically-opposed Fed and White House would inspire.

Numbers, links, and more

35%: The percentage of Democrats or Dem-leaning independents that want Biden to run for a second term. (The Washington Post)

1.43 million: The number of manufacturing jobs added in the U.S. after April 2020, a net gain over the 67,000 lost between February and April 2020. (The New York Times)

3,000: The age of an ancient canoe found in Wisconsin. (Wisconsin Historical Society)

“Massive headphones division”: Apple’s made its AirPods an astounding success for being.. headphones. (Bloomberg)

The Rise of the Rest: Will the next big tech companies come from places like Omaha and Boise? This guy thinks so. (Wired)

Did some good come out of the baby formula crisis? (The Washington Post)