“It’s One Gallon of Gas, Michael. What Could it Cost, $10?”

First time? Consider subscribing!

It’s March 8, 2022, and there’s just one lengthy piece for you to read today, plus the usual fun at the end:

When it comes to gas prices, we’re all Lucille Bluth

Numbers and links

Gas prices: We’re all Lucille Bluth

I had a Lucille Bluth moment last fall in relation to gas prices…and I’ve come to realize that there’s a little Lucille in us all.

“It’s one banana, Michael. What could it cost? $10?”

Those are the immortal words of Lucille Bluth, a character played by the late Jessica Walter on the show “Arrested Development,” displaying just how rich and out of touch she was. Michael, her son, played by the guy from “Teen Wolf Too,” Jason Bateman, proceeds to look at her and ask: “You’ve never actually set foot in a supermarket, have you?”

The joke, again, is that Lucille is wildly out of touch, as she can only guess at how much a single banana costs — and guesses $10. Now, I’m afraid I have to admit that I had a Lucille moment myself last fall.

A few friends had come to visit me in early October, and as the tank on my Forester approached “E,” I started looking for a gas station. Then, my buddy asks me, “gas has gotten expensive, what does it cost here?”

I realized I had no idea. Not a clue. I thought to myself, “it’s one gallon of gas…what could it cost? $10?”

Lordy, I had become Lucille.

The truth is, I just don’t drive much — maybe once a week. And I fill the gas tank very infrequently, maybe once a month. As such, when I do pull in for gas, I don’t really pay much attention to the price. But still, I realized I was a bit out of touch.

Of course, who would’ve thought that nearly six months later gas prices would be top of mind for many American consumers — who are already being crushed by increasing prices everywhere they look?

Prices should, some analysts are saying, push to an average of $5 per gallon soon. They’re already above that in some areas. I get it. That’s a lot. Especially considering many people were paying less than $2 a year or so ago, when demand cratered due to the pandemic. But boy, times have changed. As of this week, prices are up roughly $0.90 from one year ago. As of March 8, gas prices are at a record high.

And as I thought about it more, I couldn’t help but think that I’m not the only Lucille out there. We’re all a little Lucille, in fact. And I think that because, by and large, most of us don’t know what anything actually costs.

Inside gas prices

Now, gas is only a part of the equation in my “Lucille-All” theory. But it’s a good starting point to explain what I mean. There are a good number of people who are under the impression, for instance, that President Biden is to blame for high gas prices, as evidenced by the number of stickers I saw on a gas pump recently, blaming President Biden for high gas prices.

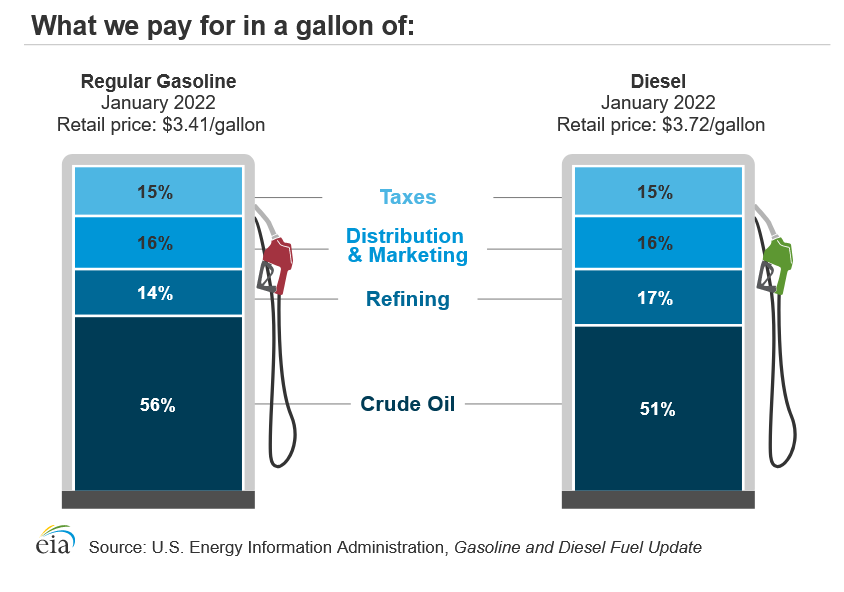

Well, Biden’s about as responsible for gas prices as former President Trump was, and neither of them are. The EIA actually breaks down how the price breaks down:

So, depending on where you live, these prices will vary. But generally speaking, half of a gallon of gas’ price is determined by crude oil prices, which are rising. And do you know what determines crude oil prices? Supply and demand, sure. But it’s important to know that the supply is at the mercy of cartels like OPEC, and even countries like Russia.

This is a key reason that many countries, businesses, or politicians haven’t wanted to stand up to the likes of Russia and, say Saudi Arabia, even after they start unprovoked wars or murder journalists.

So, supply can be constrained and production cut back in order to maintain a certain price level. Even though the U.S. has become a big producer and exporter of oil, crude is still an international commodity, and prices aren’t really easy to control. Add in a little profiteering at the expense of the American consumer (oil companies made $174 billion in profits over the first nine months of 2021, for example, while refusing to increase production), and the squeeze is on.

This is all to say that the price of gas is, well, complicated. To say the least.

So, while it’s easy to blame whoever the president is, having some context as to what’s driving prices is important. As for what’s driving prices now? A few things, but the big one is that oil producers who slowed production during the pandemic haven’t returned production to pre-pandemic levels.

As Robinson Meyer writes in The Atlantic:

“…The pandemic hit. People stopped driving and flying. Oil demand crashed worldwide…[and] that was when OPEC Plus saw its window….As the recovery began, OPEC Plus pumped less oil than the world demanded, even though it had the capacity to pump more. This spare capacity reclaimed the cartel’s market power—and allowed global oil prices to get “as high as is bearable,”…U.S. oil output is still below its pre-pandemic level.”

Higher demand, lower supply, higher prices, and higher profits.

Amazingly enough, even as prices have gone up and put even more pressure on consumers who are buckling under the weight of, well, everything, there’s also another important thing to understand about gas in the U.S.: It’s cheap.

Gas is cheap. No, really.

If you’ve ever purchased gas in another country — any other country, really — you get a first-hand account of just how much more expensive it is. I filled up a Honda Civic in Vancouver one time years ago, and it cost something like $60.

Looking at gas prices around the world, the U.S. is in the middle of the pack, but is an outlier in that it’s an advanced economy with low gas prices. Most other nations that would be lumped in the same group have significantly higher prices. In terms of U.S. gallons and U.S. dollars, the U.S. is looking at average prices just under $4 as of last week, but countries in most of western Europe are paying more than $7.50.

Scandinavian countries are paying more than $8 per gallon. And in Hong Kong, gas is going for more than $10 per gallon.

Prices have been high in parts of Europe for years, too. For instance, in March of 2005, the U.S. was experiencing then-record high gas prices of (laughably) $2.05 per gallon, Europeans were paying more than $6 per gallon.

Gas prices have been this high before in the U.S., too. Back in 2008, average prices topped $4 per gallon (today, adjusted for inflation, this would be around $5.20 per gallon), and several times over the proceeding years, bounced around between $3.50 and $4 per gallon.

If you had told me in 2008 — that spry, young, vibrant, and handsome Sam — that gas prices would somehow be LOWER for 14 years, I would’ve thought you were crazy. Oil is becoming more scarce every year as we burn through it, and yet prices went down? For nearly a decade and a half? That’s wild.

You’re probably wondering: How did we manage to keep costs contained for so long? This is another big topic to unpack, but to keep it short, we subsidize the fossil fuel industry to the tune of $423 billion each year worldwide, and we keep taxes on gasoline artificially low — so low that they don’t offset the actual costs of driving.

So, we are paying a higher price for gas than we realize, just not directly.

Taking all of this into account, it’s kind of surprising just how much of a surprise relatively expensive gas is to many people. Yes, I’m surprised by the surprise. We knew that prices were going to have to rise eventually (although maybe not this fast). And we’ve all had a long time to prepare for it.

Granted, the U.S. is a difficult place to make do without a car — that’s not really an option for many, if not most people. Public transportation doesn’t exist in many places, and outside of a couple of cities, walking or biking could take hours. In that sense, you don’t really want to blame the consumer — although there is a relationship between lower gas prices and sales of bigger vehicles. Basically, we get accustomed to cheap gas, and go out and buy inefficient cars without thinking about what would happen if prices do rise.

Well, here we are. Flummoxed at the cost of filling up the tanks on our tanks. All while we’ve had 14 years to consider ways to lessen our dependence on gasoline as a society. This is something that will likely repeat, too, with prices coming back down as politicians scramble to make something happen so they don’t get clubbed during the midterm elections this year. But next time, who knows? Maybe prices will reach $10 per gallon?

Bringing it back to Lucille

That was a lot to digest, but suffice it to say, gas is cheap, and most Americans don’t realize how cheap it is for the end-user in the U.S. The thing is, it’s not cheap — the costs of extracting, refining, and transporting gasoline to your town are more than what you’re paying at the pump.

So, in spirit with NPNR, that’s the difficult task many of us face: Coming to terms with the fact that some of our everyday expenses are considerably more expensive than they seem, and that we pay for it indirectly. Often with our health, our time, and our sanity.

When you take all of that into consideration, a gallon of gas might actually cost $10 per gallon. But who would’ve thought? I guess we’re all a little Lucille, then.

Weaning ourselves off of gasoline will be a Herculean feat, naturally, and one that not all of us will even want. Even as fossil fuels become more scarce and expensive, we remain largely at the mercy of oil company shareholders and cartels. But it’s really the only way we can insulate ourselves from price shocks like we’re experiencing now.

We have the technology to do it. It’s just a matter of making it a priority.

Numbers, Links, and Faces

230: The number of plaintiffs suing rental car company Hertz, which has been filing thousands of police reports about stolen vehicles on paying customers for some reason. (USA Today via Yahoo)

2: Additional hours added to the standard flight between Europe and Asia due to flight restrictions stemming from Russia’s invasion of Ukraine, in a “best-case scenario.” (Axios)

$4 billion: The U.S.’ share of the global $5 billion-$6 billion bird seed market in 2018. (Scientific American)

300%: The increase in fertilizer costs for some farmers in 2021. (Modern Farmer)

73%: The percentage of construction costs the public is likely to contribute to building the NFL’s Buffalo Bills new stadium, which should amount to more than $1 billion. Also interesting: In small markets, the public pays more for stadiums than they do in large markets. (The Buffalo News)

Frowny face: Health insurance companies are investing in health-related startups, as the health care system begins to eat itself. (Slate)

Smiley face: How to help Ukrainian refugees. (LinkedIn)

See you next week.