It’s March 22, 2022, and today’s newsletter comprises thoughts I’ve been wrestling with for some time. It’s a long one, thanks for bearing with me.

Our crisis is two decades in the making

Numbers, links, and faces

Our crisis is decades in the making

Decades of kicking the can down the road has led to the inevitable.

Consider what’s going on in the world. It’s a lot. It’s too much. Pandemics, wars, coup d’etats…the list goes on.

Yet, most of us are able to carry on with or day-to-day lives. We’re watching March Madness. Ordering a pizza. Playing Elden Ring. You know, carrying on with our lives in normal fashion.

But many of the societal, political, and economic squeaky wheels that we’ve ignored or otherwise fixed with some symbolic WD-40 or duct tape over the past two decades, are starting to re-squeak.

Parts of Europe are engulfed in war. The pandemic persists, even if most of us have moved on from it. Hardly a year ago, hundreds of people tried to violently overthrow the U.S. government in a hissy fit for the ages. And, of course, we’re seeing prices rise in a way that most Americans have never experienced in their lifetimes.

It feels like it’s all coming apart at the seams — and that it’s all happening right now, all at once. In a number of ways, it feels like the perfect storm. But it’s one largely of our own making. We have it all: Wars, rising prices, jobs that don’t pay enough, global supply chain meltdowns, and a populace that has, by and large, lost its interest in working altogether.

But this isn’t new. It’s been decades in the making — because instead of doing the hard work of building a strong, sustainable economic and societal backbone, we’ve focused on the short-term. We’ve strictly focused on getting the next first down, rather than winning the game.

We’re at a point where anything less than record-breaking profits during any given quarter is considered a failure. If the stock market is breaching all-time highs, we find it unacceptable. It’s completely unsustainable, of course, and fixing it is going to require a generation’s worth of work.

In the year 2000

Let’s start at the year 2000 (obviously, our problems go back further, but we’ll use it as a starting point). The economy is doing well. We’re not engaged in any large-scale international conflicts. Facebook hasn’t been invented yet, so the village idiots are still isolated to their villages. It’s a simpler time.

But then, a number of things happen: A disputed presidential election gives George W. Bush the reins, causing many to start questioning our election systems (and the Supreme Court). The terrorist attacks of September 11th occur, killing thousands, and sending the U.S. into a war in Afghanistan (that would stretch on for 20 years) and Iraq. A recession occurs. We bounce back, fueled by patriotism and a new sense of civic duty.

Then, a few years later, the housing bubble bursts, the Great Recession starts, Barack Obama is elected, passes the Affordable Care Act, we spend a lot of money trying to combat the Great Recession, and eventually, Occupy Wall Street gains traction, bringing more awareness to income inequality, and slowly, things start to normalize. But during those years, many people are concerned that the economy isn’t growing fast enough — it’s growing, but we’re simply not doing enough. At the same time the Fed starts to raise interest rates slowly (providing ammo for the next recession), and the culture war goes into full-effect — we’re fighting about bathroom access, Starbucks’ Christmas cups, and all sorts of other things. These were the precursor skirmishes to what we’re fighting about today: CRT, banning books, trans athletes, and sexy M&Ms.

It’s also worth mentioning that, as the Great Recession starts to fade, no one is really punished or held responsible for causing an economic collapse. I know that still bothers me.

It’s during this time, I think, that we start to lose our grip on the reins.

The 2010s: Losing the reins

In the mid-2010s, things were…mostly okay. We had a lot of problems to sort out as a society, but things are looking up. We were legalizing marijuana in some parts of the country. Same-sex marriage has been given the nod by the Supreme Court — people were gaining rights. The economy was still improving.

But at that time, the problems from the Great Recession were still myriad. We need more jobs, and better ones. Student loan debt is an anchor around much of the population. And the Fed’s policy of endlessly pumping money into the economy to keep the stock market afloat is still intact.

We’re in an economic expansion, but don’t dare raising interest rates to a meaningful level, or think about raising taxes.

Then, Donald Trump is elected, and pushes through massive tax cuts for corporations (which there may be reasons to do, but remember, the tax benefits for individuals and families will expire in 2025, while those corporate cuts were permanent), and the stock market keeps hitting record highs as companies buy back stocks at record levels. Interest rates are still low, borrowing is cheap, and corporations are flush with cash. We’re told we’re seeing the strongest and greatest economy we’ve ever seen.

Then, in 2018, the market sputters as the Fed had slowly been raising interest rates, and decides to taper off its quantitive easing. Trump attacks the Fed, which relents, and starts lowering rates again.

This all begs the question: How strong was the economy, really, if it couldn’t survive without life support from the Fed? This is an issue that predates Trump, of course.

It’s at this point, I think that we should’ve stayed the course. Despite the market dip, rates needed to continue going up. QE measures should’ve been tapered off years earlier. While, yes, that would’ve slowed the economy a bit, we needed ammo for the next crisis. While we kept avoiding recessions, who knew when that would occur, and what form it would take?

In early 2020, we found out.

2022: The crescendo

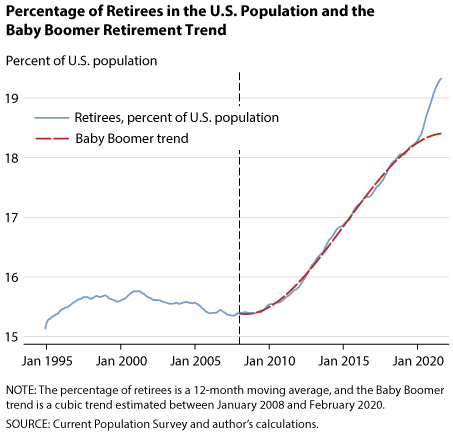

The pandemic hits, everything is thrown into disarray. We threw the pandemic playbook in the garbage, and pretend that things are fine. Eventually, we need to ask people to stay home. Businesses shut down, jobs are lost, the economy tanks. We spend trillions. A million Americans die. Millions more decide to retire.

This leads to a labor shortage. Supply chain disruptions cause prices to go sky-high. We’ve dropped interest rates as low as we can. The lack of any sort of cogent response from the government leads to Biden being elected. Political unrest ensues. The virus mutates a few times, and we can’t convince enough people to get vaccinated.

We’re out of economic ammo. We’re out of patience. And the economic noose starts to tighten, as the labor shortage leads to rising costs for labor, and supply chain disruptions lead to the rising price of…everything. Then, Russia invades Ukraine (cue more spending in military aid, and likely more military spending from governments around the world in the coming years), sanctions are levied that will send Russia’s economy back to the stone age, and a new wave of COVID deaths in China leads to further supply chain problems, that have yet to make their way down the pike to the American consumer. Brace for impact.

And here we are.

We’ve effectively been on thin ice for a long time — that includes our political system, our economy, and in terms of public health. I think we’ve simply managed to finally fall through, and now we face a tough swim to get out. I don’t think that our current situation is the grand design of corporate oligarchs, or due to the mismanagement of any one single politician, but instead, that it’s the culmination of decades’ worth of corner-cutting and capitulation.

A reality check

For the average person, this all leads to higher interest rates, higher prices, lower stock market gains (perhaps losses), and, generally, a more difficult existence. In my mind, it all comes back to our failure to really put in the work and foster healthy, strong institutions.

Our political system has been captured by commercial interests, which have been able to keep borrowing and labor costs cheap for years with 0% interest rates and a minimum wage that hasn’t been raised since 2009. We can’t pass any type of meaningful election reform laws, expand or preserve voting rights, or even simplify the way we do our tax returns — all, in large, part, due to meddling business interests.

Many corporate leaders only have a few tricks up their sleeves to help them keep market share: They can engage in regulatory capture to bend the rules, they can tap into overseas labor markets to cut costs, and further lay off domestic workers when the latest earnings report doesn’t show record-breaking revenues. Either that, or they engage in largely-unchecked monopolistic practices, gobbling up competitors, and colluding to keep workers’ salaries artificially low.

As a society, we’ve become addicted to paying lip service to our fellow Americans (everyone was a hero during the pandemic), while simultaneously throwing tantrums about making the smallest personal sacrifice for the public good — be it wearing a mask in certain settings, or needing to wait longer for a server to take our order at a restaurant. Then, we’re flummoxed that people no longer find it worthwhile to work in these jobs, all while wondering why “nobody wants to work anymore.” The fact of the matter is that a lot of jobs simply aren’t worth it — they take too much of a mental or physical toll, and don’t pay enough.

We expect our investment portfolios to gain value every day, no matter the cost. We expect our homes to gain value every year, even if it means shutting younger generations out of homeownership completely. We expect $1.99 gas and $1 cheeseburgers. Perhaps we expect too much?

In all, we’ve become completely dependent on low-wage workers, cheap, foreign-produced goods, and 0% interest rates. With the house of cards finally tumbling over, perhaps the best thing we can do is recalibrate our expectations, and start thinking about throwing touchdowns and winning the game, rather than getting the next first down.

Over the past two decades, we’ve largely been unwilling or unable to put in the work of creating a sustainable and strong society and economy. I get it. It’s hard, expensive, and takes a long time. But we’re seeing, now, what happens when you rely on shortcuts, stop-gaps, and Band-Aids.

We’ll face all of these hurdles, again, too. There will be another pandemic at some point. There’ll be another economic meltdown. There’ll be political unrest. We just need to be willing to put in the hours and rebuild our foundation to make sure we can withstand it all — or walk away from the next round in better shape.

It’ll take a lot of time, effort, money, and sacrifice — from our kids, and probably their kids, too. But this is what short-term thinking and an unwillingness to do the work has led to.

Numbers, Links, and Faces

200,000: The number of Russians who have left Russia since the start of the war. (Bloomberg)

40.3 million: The number of people worldwide who were victims of modern slavery in 2017, which led to $150 billion in annual profits in the U.S. (Institutional Investor)

5,000: The number of seats in the arena at Arizona State University, where the NHL’s Arizona Coyotes will be playing their home games for the next few years. That’s the smallest arena for an NHL team since 1930. (The Athletic)

McDonald’s ditched Russia, but Russia isn’t letting go so easily. Check out Russia’s new replacement: Uncle Vanya. (Crain’s Chicago Business)

Homeowners earned more from their homes last year than they did from their jobs. (The Wall Street Journal)

Frowny face: The NFL’s Cleveland Browns traded for quarterback Deshaun Watson, who’s been accused of sexual assault by 22 women, and gave him a contract with a record $230 million in guaranteed money. What sort of message does this send? (The Sporting News)

Smiley face: The Cleveland Rape Crisis Center received more than 1,000 additional donations after the trade for Watson. (Cleveland.com)

See you next week.

Good read Sam!