Remote workers: The new Californians?

Note: No newsletter next week, because it’s a holiday and I’m going to…do something else. It’s May 25, 2022. Here’s the rundown:

Remote workers: The new Californians?

Guest post: Three options for the “Gamvestor”

Numbers, links, and faces

Remote workers: The new Californians?

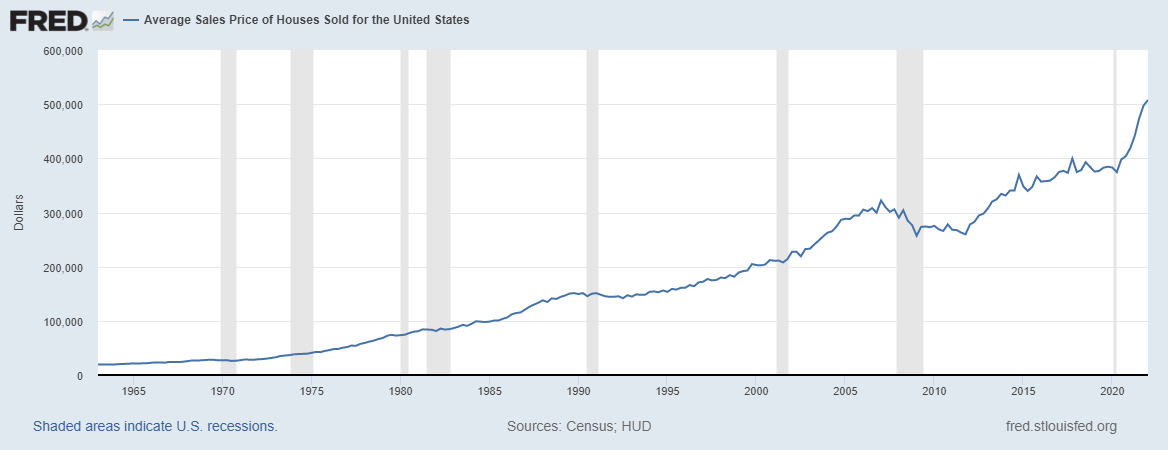

A shift to remote work is responsible for part of national housing price increases.

It’s fun to blame Californians for everything, isn’t it? That’s something of a past time out west, where people are moving to smaller, cheaper areas. Of course, this is happening everywhere, from Texas to Tennessee, but Californians usually bear the brunt of the blame.

There may actually be something to it, too. Not the Californian thing, necessarily. But the fact that people are moving to cheaper areas and are subsequently driving up home prices. I’ve written about this before — places like eastern Washington, Idaho, Texas, and others are seeing house prices increase substantially as more people move in.

Now, we have an explanation for some of it: Remote work.

A new NBER working paper finds that “the shift to remote work explains over one half of the 23.8 percent national house price increase” since late 2019.

“…we estimate that an additional percentage point of remote work causes a 0.93 percent increase in house prices after controlling for negative spillovers from migration. This cross-sectional estimate combined with the aggregate shift to remote work implies that remote work raised aggregate U.S. house prices by 15.1 percent.”

Average home prices have increased at a record pace over the past couple of years, and now sit at more than $500,000.

The median price is now almost $430,000:

To break this down, what we’re seeing is that areas that are rife with high-paying jobs (think New York City, Los Angeles, San Francisco, etc.) also have a high concentration of jobs that can be done remotely. Many of the workers doing those jobs started doing them remotely due to the pandemic, and a lot of them will continue to do so.

Those workers are now moving to cheaper parts of the country — where their relatively high-paying jobs give them an awful lot of options when it comes to real estate. If you could only buy an apartment in Manhattan for $900,000, imagine how far that much money will go in Manhattan, Kansas?

As such, remote workers are dragging up home prices all over the place. Obviously, this is frustrating for many people who don’t have relatively high-paying, remote-capable jobs.

Now, it’s not that these remote workers have done anything wrong; they’re simply acting in their own best interest. And locals in these areas now experiencing price crunches are understandably frustrated — you can’t blame them, either.

It all comes back to the fact that we just don’t have enough homes in the U.S., and that we’re not doing enough to solve the problem. How do we solve the problem? I don’t know, I’m not a housing economist. But it’s easy to see that this is an untenable situation.

And if you want someone to blame? Well, that’s another frustrating part of this, because there isn’t really anyone to blame. Everything is expensive, and while rising interest rates are evidently cooling the housing market (see the numbers and links section below), it’ll be hard to wind back the clock to when a home could be purchased (or, hell, even rented) at what was once considered a reasonable price.

Gamvestor 👉 Investor

A guest post by Michael Huskey.

No way around it, the market this year has been a dog. Except if you are in oil stocks, but I’m not sure your gains in Chevron are going to make up for your losses at the pump.

If you started investing in 2020 and subscribed to the “buy the dip” strategy or you were taking your stock picking cues from Wall Street Bets and Davey Day Trader, you probably don’t know where to turn right now. And based on the action I have seen in the market I think a lot of people are taking a turn and exiting stage right, and taking what money they have left right out of the stock market.

You might be wondering, how did we get here and what’s next? I think a large contributing factor to our recent stock crash is the proliferation of the “gamvestor.” You probably have never heard of this term, it is something I made up to describe people who think that because they buy stocks that makes them an investor. When in reality they share much more similarities to a gambler, hence the term gamvestor.

If you were someone who was caught up in the craze and started buying stocks in companies that had flashy ad campaigns, charismatic CEOs, or you got a tip on a Reddit board you are not alone. It was a wild time and it seemed like every week there was a new millionaire on Reddit because they invested in some obscure medical device company or better yet AMC. But now the environment is different, interest rates are going up in an effort to fight inflation, and once red hot pandemic stocks like Peloton and Zoom are crashing harder than Biden’s approval numbers.

But now we are at a crossroads. The S&P 500 is down 16% for the year and every week your account balance is going down, what’s next. I think there are 3 options that face every gamvestor.

Option 1: Ditch the entire asset class of stocks and put all your money back in the bank where it is “safe.”

Option 2: Double down assuming that this dip is going to be the same as all of the others.

Option 3: Take this opportunity to transform from a gamvestor into an actual investor.

My recommendation would be Option 3, and if that’s where you are leaning I’m sure you are wondering how to make that transition. The answer is slowly and carefully. The reason I say slowly is that if you think of the stock market as a way to get rich quickly you are treating it as a casino. And the reason I say carefully is investing is very similar to working out. We all know a friend who when they start to workout will go really hard for a week only to end up injuring themselves and end up not going back for a couple of years.

As you begin your transition from gamvestor to investor there are 3 books that I recommend: Rich Dad Poor Dad, One Up Wall Street, and Get Rich Carefully. They are quick reads and also serve as a litmus test of your interest in the stock market. If, like my wife, you can’t read more than 5 pages without falling asleep, it is probably best to have someone else manage your money, which is not a terrible self-realization. Better have someone else manage your money than you mismanage your own money.

I also recommend checking out my newsletter What You Missed This Week, where I digest some of the biggest news in the stock market and distill it into facts that affect you, WITHOUT hyperbole or clickbait. I also have a premium offering where I give subscribers insight into the trades that I am making in my own portfolio. It isn’t flashy, but whenever I make a trade I explain my logic and reasoning in an effort to educate readers so as they grow in their investing journey they will be able to make their own decisions.

Numbers, Links, and Faces

18,000+: The number of Dollar General locations in the U.S. (Forbes)

-16.6%: The month-over-month decline in new home sales. (U.S. Census Bureau)

3.66 million: The number of babies born in the U.S. last year, an increase for the first time in seven years. (The Wall Street Journal)

Robo-overlords?: Should we really be worried that robots are going to replace our jobs? (The New Yorker)

Frowny Face: Over the years, Haitians have paid around $560 million to former French slave masters for their own freedom. (The New York Times)

Smiley Face: This woman is trying to photograph every federally-recognized tribe in the U.S., and has logged more than 600,000 miles to do it. (The New York Times)