It’s August 31, 2022. No newsletter next week. Here’s the rundown:

Remember revisions!

A look at recession-proof stocks

Numbers and links

Remember revisions!

Don’t forget that numbers, like GDP and jobs figures, can, and do, change.

Many people sit idly by waiting for big economic indicators and numbers to be released, such as employment numbers and GDP figures. When they are released, they generate tons of headlines and discussion, and after a few days, we forget all about them and look ahead to the next big release.

But these figures are often just initial estimates and are generally revised a while after they’re released. The revision gives us an even better idea of what’s going on in the economy, even if we typically don’t pay nearly as much attention to them as a part of the news cycle.

Case in point: The Q2 2022 GDP numbers that were released on July 28 showed that the economy contracted 0.9%. Or, put another way, the economy grew by -0.9% during Q2 2022. As you remember, that kicked off a whole round of “are we or aren’t we” in a recession talk that lasted for a couple of weeks.

Well, a few days ago, those numbers were revised, and they actually showed that the economic contraction wasn’t as bad as initially estimated. This “second estimate” shows that the economy contracted by 0.6%, rather than 0.9%. While it may not make much of a difference, it is important to know that the initial numbers from these big reports can and do change — whether it’s GDP figures or employment numbers.

For example, the latest jobs report, released on August 5, showed that the economy added 528,000 jobs during July. But it also includes some revised numbers for June and July:

“The change in total nonfarm payroll employment for May was revised up by 2,000, from +384,000 to +386,000, and the change for June was revised up by 26,000, from +372,000 to +398,000. With these revisions, employment in May and June combined is 28,000 higher than previously reported.”

Again, does this have any real material effect on most of our lives? No. But I think it’s important to know that the data and numbers are fluid and that the data paints a clearer picture over time.

A look at “recession-proof” stocks

This is where the money goes when the economy tanks

Are we in a recession? Does it matter?

I don’t know, and neither do you. And I don’t think it matters. But one thing that never hurts is to take a look at some of the places that capital flows to in the event of a recession — such as stocks that are generally considered “recession-proof.”

Obviously, nothing is really recession-proof, but there are certain businesses and industries that perform better during economic downturns, or in spite of them. Or, to think of it another way, there are things people are always going to buy or spend money on, no matter what’s going on in the economy.

That’s really it — that’s what gives certain companies or industries a bit more cushion during a recession. They almost have guaranteed sales, and with built-in demand for their products or services, they won’t need to lay as many workers off, cut forecasts, etc.

That’s not to say that these companies could get pummeled. That’s always a possibility. But a grocery store chain is much more likely to come out of a recession unscathed than, say, a company that builds yachts.

Some examples? Food and groceries. Healthcare. Consumer staples (like toothpaste and toilet paper). These are things that people will always buy.

So, if and when the economy does enter a recession, stocks in these types of industries may be “safer” than others. And when looking at what “recession-proof” stocks are out there, a quick Bing search will net you a whole bunch of results.

And while I am not recommending anything here, these are some of the commonly-cited “recession-proof” stocks among these numerous lists:

Walmart (WMT)

Target (TGT)

Kroger (KR)

Costco (COST)

Kraft Heinz (KHC)

Dollar General (DG)

Dollar Tree (DLTR)

Procter & Gamble (PG)

Pfizer (PFE)

Johnson & Johnson (JNJ)

I could list many more. But don’t forget about others, such as utility companies or even internet service providers — those are other services people need and will continue paying for through a downturn.

It may be a better bet, if you actually plan to adjust your portfolio in anticipation of a recession, to look at sector ETFs rather than individual stocks like those listed above. That’ll offer some diversification to help smooth out the ride.

Remember, too, that certain industries have traditionally been considered recession-proof. Those industries may have public companies within them that you can invest in. They include alcoholic beverage producers (BUD, or ABEV, for example) or tobacco companies (BTI, IMBBY, MO, PM). Maybe even gun makers.

As much of a bummer as it is, economic strife does lead people to seek an escape, often in the form of a cold one. It’s up to you as to whether you’d be willing to invest in so-called “sin stocks,” but it’s an option.

Numbers, links, and more

53: The number of years this 77-year-old Japanese man has been driving the same Toyota Corrolla. (YouTube)

$4.7 trillion: The collective wealth of the 735 billionaires in the U.S. (Visual Capitalist)

1 foot: The resulting sea level rise by 2100 as Greeland loses 3.3% of its volume. (Nature)

Student loan credit: An interesting take on the difference between student loan debt and student loan credit. (Notes on the Crises)

Death of a boom: The spending spree on life insurance policies, fueled by the pandemic, is petering out. (The Wall Street Journal)

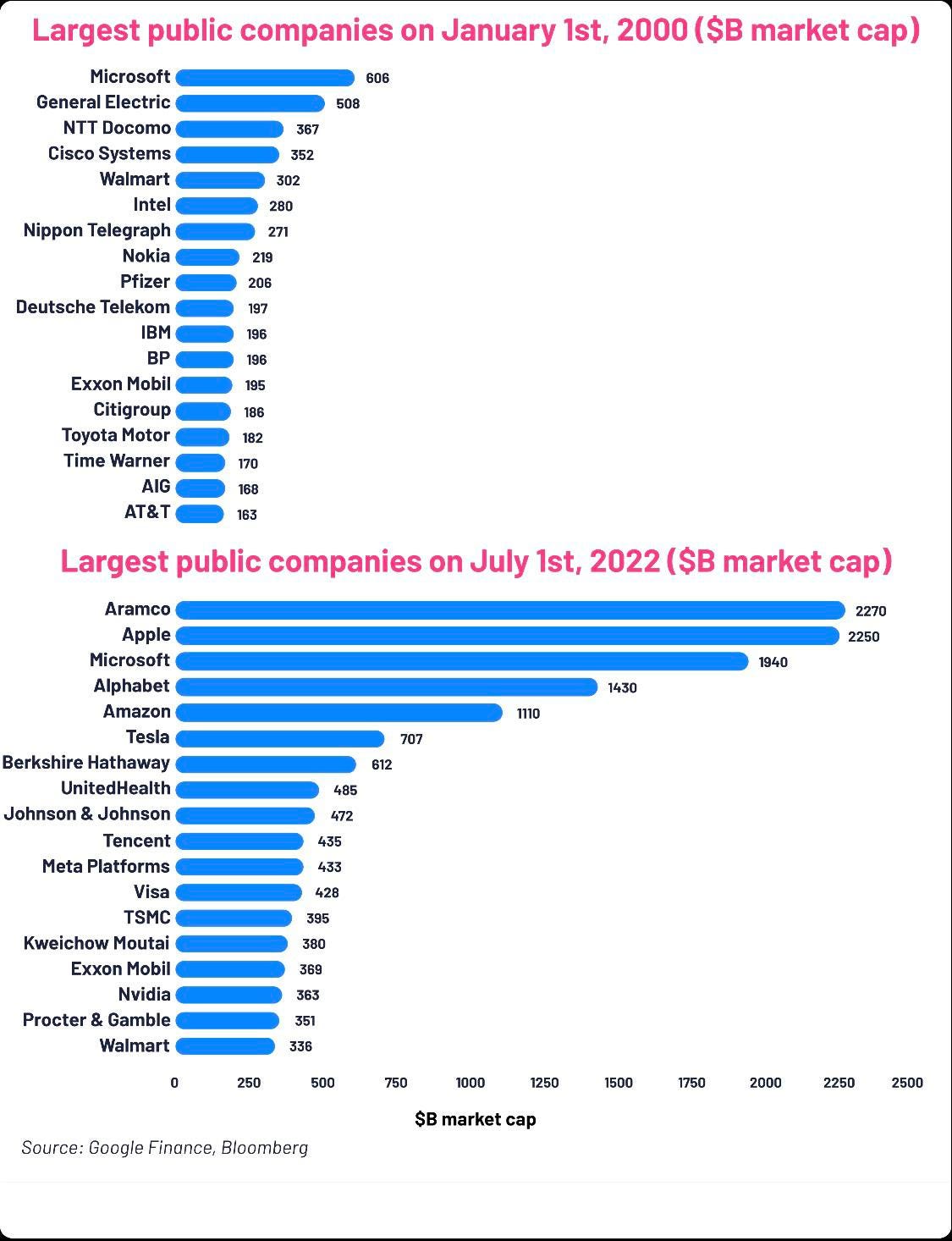

Public companies: An interesting comparison between the largest public companies in 2000 and as of today:

Speaking of “sin” stocks, back in the early 2000s I put money in the then named Vice Fund, which of course invested in gambling, alcohol, and defense stocks. At the time it turned out to be a huge loser and I got out. I then did much better in socially responsible stocks which convinced me that God was telling me to stay away from “sin.”