The rundown:

The one weird trick business schools teach managers

Business and government leaders signal what’s ahead: Hard times

Numbers, links, and faces

Your boss with an MBA? They have a trick up their sleeve

Managers with business school degrees are really good at paying people less.

I recently wrote a lengthy screed outlining my thoughts on the current state of, well, everything, and how it’s been decades in the making. If you were able to make it through it, I appreciate your patience.

One of the main points I touched on in that post was that many of our business leaders actually fail (or have no interest in) producing anything of value. Rather, they devise ways to suck up more revenue without providing additional value to consumers or the economy. They do so through regulatory capture, market manipulation, and a few other tactics.

While that thought had been bouncing around in my head since, say, 2008, it was reinforced recently when I was interviewing someone for a story I was writing about MBA programs for Fortune. An expert told me that a lot of MBA programs are kicking out graduates that focus on a few things to keep shareholders happy: Layoff domestic workers and offshore operations to increase profitability and engage in stock buybacks.

Obviously, MBA graduates can and do much more than this, and many are talented managers. But given that it’s hard to innovate — and relatively easy to find other ways to increase the bottom line — it’s not hard to see why this point is salient.

Well, my suspicions have been confirmed.

A new working paper from the National Bureau of Economic Research shows that business schools are indeed better at teaching future business leaders and executives to find ways to lower workers’ wages, rather than increase sales. Bloomberg wrote about the paper here, for further reading.

In short, an analysis of firms in both the U.S. and Denmark found that workers overseen by managers with business degrees see declines in pay. Specifically, wages dropped by 6% at U.S. businesses and by 3% at those in Denmark after five years.

Not just that, but these managers don’t really do much else besides lower people’s pay:

“Our evidence suggests that business managers are not more productive: firms appointing business managers are not on differential trends and do not enjoy higher sales, productivity, investment, or employment growth following their accession.”

It’s an interesting paper, and it’s at least worth reading the abstract. Given our current economic situation — one in which wages are growing but are relatively stagnant, while corporate profits soar at the expense of everything and everyone — it’ll be interesting to see where the research goes in the coming years.

Business and government leaders send a message

Recent comments from BlackRock’s president and a U.S. Senator make it clear that younger Americans should recalibrate their expectations about the future.

A couple of years ago, I wrote an essay about how I spent several months sleeping in a hallway while I stashed away enough money to get an apartment when I was a fresh college graduate. This was in 2009, and it was a different time. The essay, in a nutshell, discusses how I found a way to become comfortable with discomfort, and how that served me in the subsequent years.

Some new research shows I touched on something in that essay. A new paper published in “Psychological Science” finds that people who embrace discomfort see dividends in a boost to motivation. It’s a dynamic at play when you work out — you deadlift all that weight, thinking you’re going to die, but after you do it, you feel great!

So, why bring it up? Because many of us would likely benefit from learning to embrace discomfort as the screws continue to tighten.

The screwdriver takes the form of everything, everywhere, all the time. But more specifically and immediately, it’s rising prices, fewer resources and opportunities, along with a fun round of the blame game. BlackRock President Rob Kapito decided to kick things off, per Bloomberg News:

"For the first time, this generation is going to go into a store and not be able to get what they want…And we have a very entitled generation that has never had to sacrifice.”

As an entitled millennial myself, I had to spit out my Beyond Burger and carefully shake the avocado toast crumbs from my lap out, as I took a break from killing Applebee’s/the nuclear family/beef sales to try and really understand who, exactly, Mr. Kapito was talking about.

Not the 65-year-old Mr. Kapito’s generation, of course. No, as we all know, they had it rough. Instead, he was referring to younger generations, who, as we also know, have had a relative cakewalk over the past 25 years.

I don’t need to tell you that Gen Y (millennials) and Gen Z are poorer than previous generations, earn less on average, can’t afford homes or college degrees, or have children. And, of course, are the ones who will have to bear the burdens of climate change, and insolvent social programs. These generations will — and should, by Mr. Kapito’s logic — be ready to sacrifice.

On that final point, Senator Mitt Romney floated a trial balloon of an idea recently as well, which was that we should cut retirement benefits. For future retirees. From Business Insider:

“If we're ever going to get a handle on our debt, we're gonna have to find a way to either increase revenue, which I don't favor, or find a way to adjust our long-term benefits not for current retirees,” he said at a Senate Budget Committee hearing on Wednesday, seemingly ruling out any tax hikes.

“But for younger people coming along, we got to be able to find a way to balance these programs or we're gonna find ourselves in a heap of trouble,” he said. He didn't specify which programs, but a pair of safety-net programs that provide benefits to retirees include Social Security and Medicare.

So, I have a generally favorable view of Mr. Romney. I don’t think he’s bonkers, as I do with some other politicians. But the suggestion here, as I see it, is that we’re going to need to take benefits away from the current generations that are paying for them, rather than raise taxes to fund these programs. That, of course, is going to at least be part of the solution, but is an absolute non-starter in his eyes.

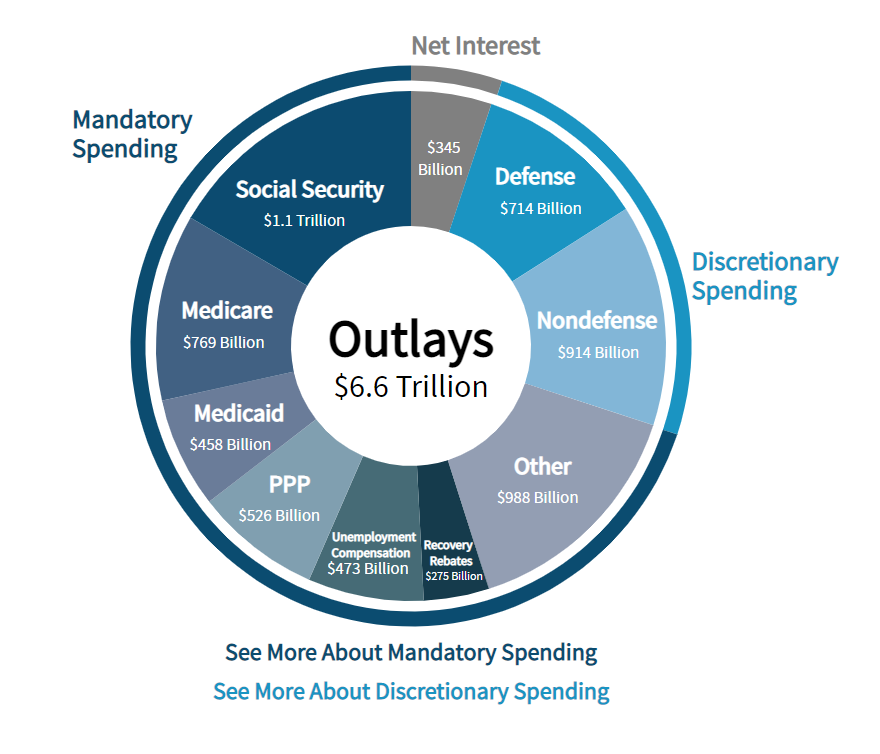

The two programs at the center of the conversation are Social Security and Medicare, both social programs (mostly) for the elderly, and which, combined, eat up about 40% of the federal budget. He’s right, we need to get a handle on this. Here’s a breakdown of federal government outlays for the fiscal year of 2020, to give you a better idea of where most of your tax dollars go, per the CBO:

Mr. Romney’s comments aren’t crazy. He’s simply among the first to suggest that “future retirees” get ready for a loss of benefits. By 2033, benefits will start to diminish, assuming Congress takes no action at all. With that in mind, maybe we should all anticipate discussions like this becoming more frequent in the future.

Now, at some point, I do think that Congress will take some sort of action, but we’re going to ask Americans to do one of two things to keep these programs around: Pay more in taxes, or accept a reduction in benefits. Both are political suicide, of course, and whatever party ends up doing whatever they choose to do to shore these programs up will probably pay dearly for it — similar to what happened to the Democratic Party after passing the Affordable Care Act, which saw them lose 64 seats in the House during the 2010 midterms.

That’s a whole other issue: There are few incentives for politicians to take action.

But Mr. Romney seems to think that the correct course of action here is to ask future retirees to sacrifice — much like Mr. Kapito. The recent comments from both of them are meant to start preparing us all for the blow. What does it all mean? That life, for a lot of younger people today, is going to be worse and more difficult than it was for previous generations. It doesn’t have to be, but it will.

Life isn’t fair, of course, and at some point, someone needs to roll up their sleeves, do the work, and take it on the chin for making the effort. But asking the generations with the least to sacrifice for those that have the most? It’s a tough pill to swallow. While you’d expect older Americans to have more wealth, there is a pretty steep drop-off in terms of what people are even able to sacrifice, when push comes to shove:

Source: Visual Capitalist

The takeaway from all of this? We’re in for a long, bumpy, and uncomfortable ride in the coming decades, And it doesn’t sound like it’s going to get any easier, or that anyone is really willing to try and lay the groundwork to make it easier.

I typically hate discussions about intergenerational feuding, but it’s becoming clear that there is an expectation that a certain segment of Americans will be able to die comfortably, while everyone else will be expected to go all scorched-earth to make it happen.

To remain optimistic (thanks to John for reminding me to try and stay positive!): We can get through it, and hopefully leave the world a little better and fairer for our kids and grandkids. But it won’t be fun or easy.

We’d better get comfortable with being uncomfortable.

Numbers, Links, and Faces

100: The number of years ago that the Supreme Court granted Major League Baseball antitrust exemption, effectively allowing it to act as a monopoly. Bernie Sanders is taking aim at those protections. (The Athletic)

20-25: Stores Barnes & Noble plans to open during 2022, marking the return of the bookstore after years of industry contraction (maybe?). (Bloomberg CityLab)

$7 billion: Marijuana purchases being disguised by cashless ATMs. (Bloomberg Businessweek)

$850 million: The taxpayer funding secured to build the Buffalo Bills a new stadium. (The New York Times)

7 million: The number of children who have lost a parent or caregiver to COVID so far. (STAT)

Horse murders: Somebody is killing wild horses in Arizona, and one lady is out to find them. (Time)

“Things got a lot worse more quickly than we expected.”: Experts talk about the future of American democracy. (The New York Times)

Frowny Face: Investors are behaving like a recession’s on the way — which, when you think about it, is literally always the case. (Institutional Investor)

Smiley Face: We’re making headway in saving endangered sea turtles, so that’s something. (Popular Science)

Arrivederci!

Isn’t it ironic that the people talking about how the (already struggling) younger generation should struggle still more are all insanely rich? And, none of them, not a one, seems willing to shoulder any of them blame or responsibility for solving the nation’s fiscal problem.

When did business admin convert to business executive? An ironic part of the name of the degree as well