It’s July 27, 2022. Here’s the rundown:

If we’re going to pay for it anyway…

Crypto companies are making users’ money disappear

Numbers, links, and more

If we’re going to pay for it anyway…

Numbers are tricky — and it’s important to consider how we frame and think about them.

Several years ago, before (or as?) the world went to hell in a handbasket, Bernie Sanders floated a plan for implementing a single-payer healthcare system in the U.S. The biggest turnoff, for many people, was the price tag: Almost $33 trillion over ten years, by one estimate.

That’s a lot of money, and that became the focus of many attacks against the proposal.

But Sanders countered that the estimate actually showed something interesting: The $33 trillion would actually be less than what we would’ve spent anyway, according to a projection from the Department of Health and Human Services. Now, there are a lot of numbers and variables in these estimates and projections, but for simplicity’s sake, we’ll go with what Sanders said at the time — essentially, by spending a lot of money to solve a problem, we save money in the long run.

Our big hang-up, it seems, is the price tag of fixing big problems. And when we look at a $33 trillion (potential) fix, it’s off-putting.

Well, there’s another big-ticket item on the list, and we’re experiencing a similar sense of sticker-stock — this one concerns clean energy.

The cost of switching the entire planet from fossil fuel energy sources to 100% renewable energy would be $62 trillion, according to a group of researchers at Stanford.

Yikes. That’s more than double Bernie Sanders' healthcare plan price, and obviously, a non-starter right off the bat.

But here’s the thing: The researchers estimate that the $62 trillion spent could lead to annual savings of $11 trillion. The whole thing would pay for itself within six years, and create 28 million long-term, full-time jobs worldwide.

And, again, we’re going to be spending that much on energy either way. It’s not an additional $62 trillion — it’s money that’s already going to be spent. So, why not spend it wisely?

An aside: Yes, the feasibility of such a project is debatable — but we’ll leave that for another day, since I don’t know anything about anything. But you should be aware that there are plenty of reasons to think it’s not, or to at least be skeptical of the numbers in studies like this one.

So, again, big upfront cost, but big, long-term savings. And sustainability. And something to help keep our kids from dying in a skirmish over a bottle of Evian in Nevada in 20 years.

I, for one, think that this type of large-scale energy transformation isn’t only needed, it’s inevitable. At some point, the financials will be too difficult to ignore, and we’ll start implementing renewables left and right, rather than continue to rely on fossil fuels, which are getting more scarce and more expensive every passing year.

But the sticker shock is hard to overcome. I understand it. $62 trillion? It might as well be $33 gazillion to the average person — it’s a number so large it’s almost devoid of meaning. However, I do think it would do us all some good to start trying to grapple with numbers like this. We’re facing huge, existential problems which will require generational efforts to mitigate. Literally — the issue of climate change is probably the single most dire and expensive that humanity has ever collectively faced.

It’s a big problem, with big numbers attached to it. Let’s not allow ourselves to be completely dissuaded by huge numbers, especially if big upfront investments will reap massive rewards over the long term. In my opinion, doing nothing is going to be much more costly.

And, let’s not all forget this fantastic headline from “The Onion,” which I think meshes nicely with this discussion:

Crypto companies are taking money and disappearing

The crypto markets are taking down crypto companies — and your money, too.

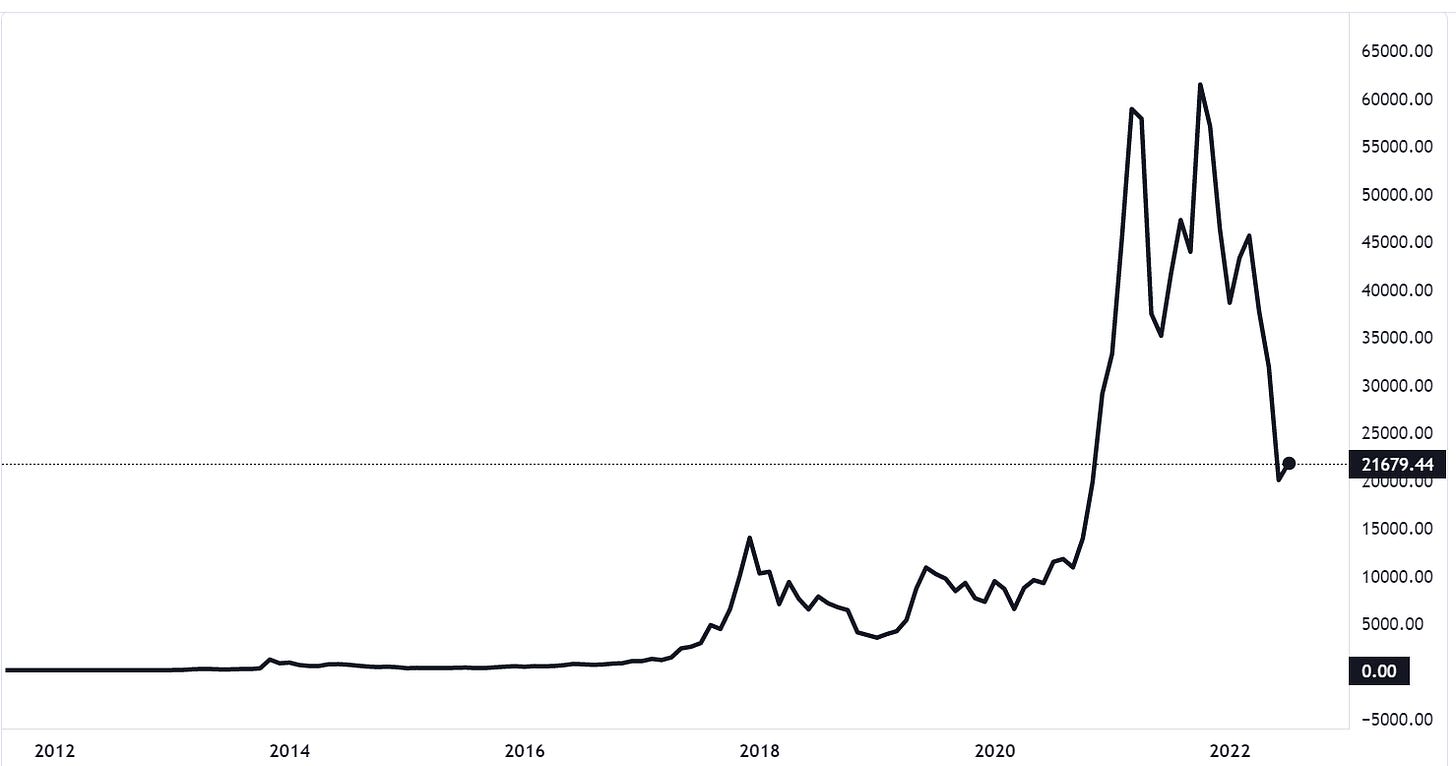

Image: TradingView

The crypto market’s been in bad shape this year. And it’s taking down a lot of crypto-related companies with it.

Case in point: Celsius, a crypto trading platform that is in the hole after the bottom fell out of the crypto market, as reported by The Financial Times. The company filed for Chapter 11 bankruptcy, and among its $5.5 billion in liabilities is $4.7 billion owed to its users. As Gizmodo reports, the company only has $4.3 billion in assets — so…guess who’s probably not getting their money back? That’s right, the users.

This was always the big risk with crypto. There are numerous exchanges and trading platforms out there, many of which act and perform like banks or brokerages, and whose users treat them as such. But they’re not banks or brokerages and aren’t regulated like banks or brokerages. And, of course, don’t offer users or customers any protections.

If a bank loses your money, you’re insured for up to $250,000 through the FDIC. Crypto is not insured the same way. Note, though, that some exchanges do provide protections. Coinbase, for instance, holds cash in U.S. banks so that users’ stored values are protected by FDIC insurance. You need to be careful, though, as some crypto companies are lying to users about FDIC coverage.

So that brings us back to the main issue: Crypto is unregulated, and it’s the wild west. That means that Billy the Kid can come and rob you, and the sheriff isn’t going to assemble a posse to make sure you get your money back.

As such: If a crypto exchange loses your money, as it appears may have happened with Celsius, you’re out of luck.

Further, many Celsius users evidently didn’t actually own their crypto holdings at all — something that’s not uncommon in the crypto space. From Gizmodo’s report:

The bankruptcy filing notes that users who signed up for Celsius all agreed to terms of service that allowed Celsius to just stop withdrawals at any time. And it’s honestly a bit shocking to see it all laid out in the bankruptcy paperwork in such stark terms:

The terms of use that form the basis of the contract between Celsius and its users explicitly state that in exchange for the opportunity to earn rewards on assets, users transfer “all right and title” of their crypto assets to Celsius including “ownership rights” and the right to “pledge, re-pledge, hypothecate, rehypothecate, sell, lend, or otherwise transfer or use” any amount of such crypto, whether “separately or together with other property”, “for any period of time,” and “without retaining in Celsius’ possession and/or control a like amount of [crypto] or any other monies or assets, and to use or invest such [crypto] in Celsius’ full discretion.” A version of this statement has been in every version of Celsius’ “Terms of Use” since 2018. And since 2019, the Company has been clear that it might “experience cyber-attacks, extreme market conditions, or other operational or technical difficulties which could result in immediate halt of transactions either temporarily or permanently.”

Did you catch all that? You weren’t buying crypto and having Celsius hold it for you. You were transferring “right and title” of your crypto to the company.

Now, I don’t want you to think that this is my attempt to dunk on crypto as a concept. I do think, as I’ve written before, that some crypto projects have a lot of promise, and will stick around for a long time. But I do shake my head when I hear about people “investing” in crypto, as it’s not an investment. Many, if not most cryptocurrencies are not backed by anything at all — you own nothing when you buy (most of) them.

And a lot of crypto companies can and will lose your money, and there is no recourse for getting it back. Using them is a gamble. There are some people and entities making a lot of money from crypto, but it’s probably not going to be you.

Finally, consider a recent study from CoinJournal.net, which found that 42% of crypto exchanges that have closed over the past eight years have disappeared without a trace. And presumably, with many users’ money and assets. Here’s a look at the reasons exchanges have failed:

If you take away “rebranding,” “business reasons,” and “regulatory reasons,” more than half of exchanges that have shut down since 2014 have done so due to scams, hacks, regulatory problems, or just flat out disappeared. This doesn’t inspire confidence.

Having seen what happened with Celsius, you should be wary if you have a significant amount of crypto holdings. You’re not protected, and no one is really looking out for you. That’s not to say that some big crypto companies aren’t safe to use, because there are options out there.

But crypto, as it stands, is still a gamble. And the house always has an advantage — and it could mean just taking your stack of chips and walking away.

Numbers, links, and more

53%: Percentage of high school grads from the class of 2020 in Indiana who are college-bound — a stat that is “alarming” to some. (Tribune-Star)

-$0.32: The fall in gas prices over the past two weeks. That’s good, right? (Associated Press)

5.4%: The increase in retail store sales of economy beer during June — cheap beer and cigarettes are hot commodities. (The Wall Street Journal)

$2,500: The additional amount rural households are paying for gasoline today than they were two years ago. (NPR)

What killed Blockbuster?: A combination of things. (The Tycoonist)

“…why I have such a hard time imagining anything much worse than a medium (worse than a mild) recession”: (Ritholtz)

“…some exchanges do provide protections. Coinbase, for instance, holds cash in U.S. banks so that users’ stored values are protected by FDIC insurance.”

That’s not how FDIC insurance works. Deposits are ensured up to $250,000 in case the bank holding the deposit fails. I’ve seen several stories in which crypto companies are claiming their funds are federally insured, but that’s true only if the bank holding them fails not the company that deposited the funds. Unless I’m totally missing something here….

I live outside of Boston and the spend large amounts of money to save money over time is playing out in regards to the public transportation system. The whole thing is broken and needs to be scrapped and rebuilt from the ground up. Of course, what will continue to happen is they will throw hundreds of millions to try to patch together a fix on infrastructure from the early 1900s.