Workers: It's time to make your move — and the clock is ticking

Was I too harsh on Netflix last week? Maybe. I did forget about “American Vandal,” which is one of the best comedies I’ve seen in many years (season one…I didn’t see season two).

Anyway, it’s May 10, 2022. Here’s the rundown:

Annnnnd it’s gone: The market gets clobbered

This is the time to make a career move

Numbers, links, and faces

Annnnnd it’s gone

The market’s getting clobbered. Consider the big picture.

Some people made a lot of money as the stock market hit record highs repeatedly over the past couple of years. This, despite turmoil gripping the world — pandemics, political unrest, wars, supply chain problems, etc.

But since the start of the year, things haven’t been so rosy. While we were able to stave off a big recession during 2020 by shooting every arrow in the quiver at the problem through big stimulus programs and more, it’s all catching up with us. As it always would, sooner or later. There are myriad reasons for it, but as rising prices have gotten completely out of control, the Fed finally stepping up and raising interest rates and weaning us off of its QE programs has caused the proverbial Jenga tower to sway.

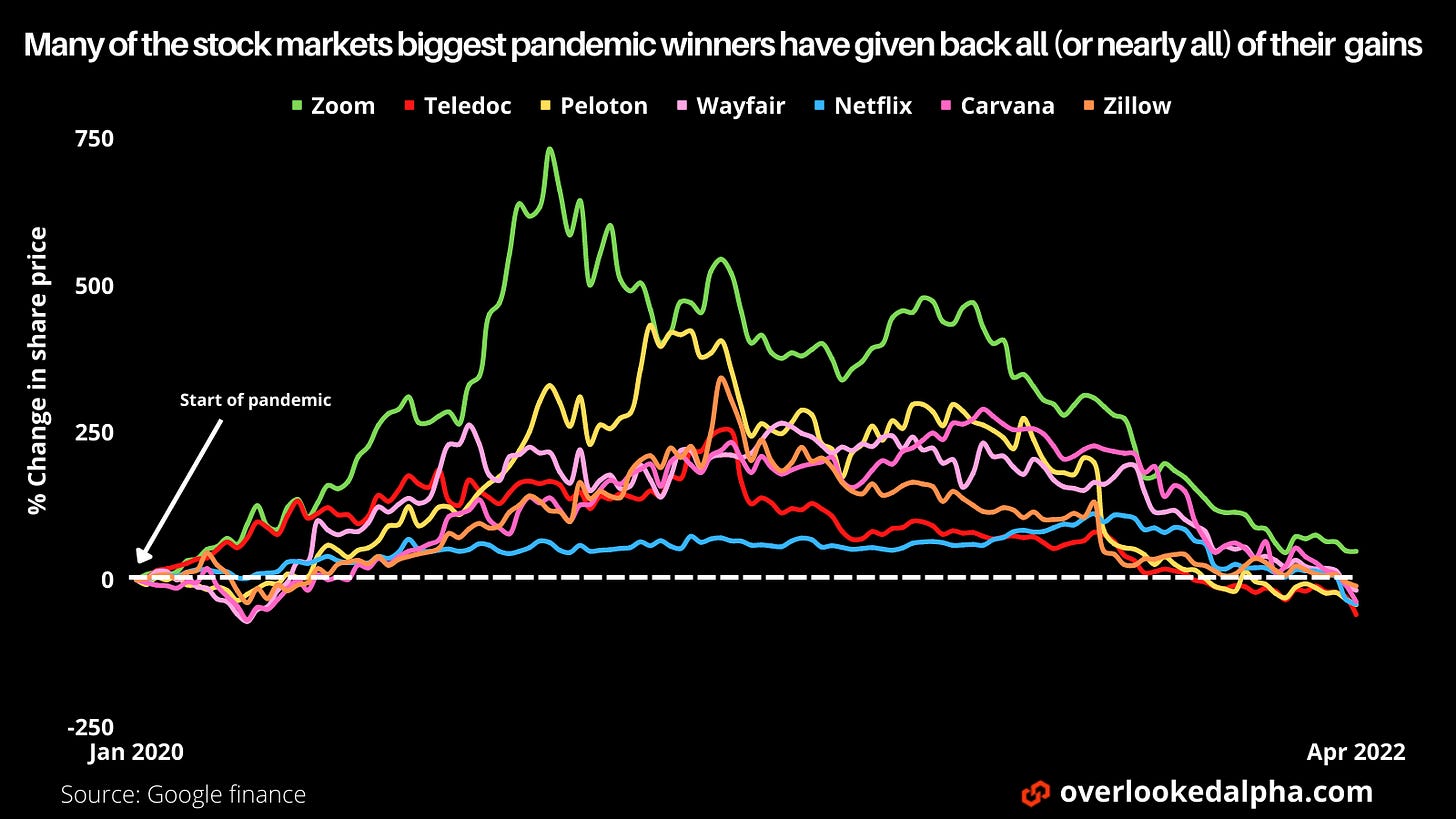

I came across this chart showing that some of the stocks that took off during the pandemic have, as of April, given up pretty much all of their gains:

This is a small sample of companies that were uniquely suited to thrive during the pandemic. To be fair, other companies saw gains, too, and are still flying relatively high.

But the recent market turmoil does and should provide a little moderation. For many people, putting money in the market in almost any form over the past 12 years has led to gains. Big gains, in many cases. There’s almost a feeling of entitlement that investors should see huge gains year in and year out.

That’s why the market getting “clobbered” in recent months has many people wondering what is going on. For instance, here’s the Nasdaq since the beginning of the year:

Images: Nasdaq

And here’s the S&P 500 (SPX):

Doesn’t look good, does it? But what if we zoom out a bit, and give it a little more context? Here are both the Nasdaq and SPX over the past five years, just for comparison:

(You can ignore the selected date in the chart below)

On a five-year time scale, things look pretty damn good. Considering what’s happened in the world over the past five years, too, who could complain about this type of market performance?

That’s not going to stop the financial news from decrying the coming apocalypse, of course. Because that’s their job. But this is why it’s important to ignore the day-to-day and look at the bigger picture. Yes, some people are losing money, interest rates are going up, and we’re looking at a looming recession. But the markets needed to calm down, interest rates needed to go up, and a recession is always coming.

It’s important to moderate your expectations. Let’s be real: The market’s probably not going to see a huge rebound this year. We dodged a big recession, and it’s likely that the economy will contract again this year (if the next GDP report shows negative growth, that’ll put us in an official recession). But it’s all a reversion to the mean.

Just like Zoom or Peloton stock. We can’t expect unfettered growth and gains forever. Many people are still way better off now than they were in years past. Whatever’s gonna happen is going to happen.

In all likelihood, we’re not facing another 2008 or 2020 type of situation. A minor or even moderate recession or bear market should feel like a breeze in comparison.

*Sponsored section

Live in San Diego? Have a pet?

Hey, San Diego! Southpaw Vet is open for business!

Southpaw offers a wide range of services to keep your pet happy and healthy. Get in touch to schedule a “nose-to-tail” consultation, and get your pet on a regular, annual schedule to make sure we’re preventing and correcting any health issues early on. Southpaw also offers pet dentistry services, nutrition consultations, and even has an online pharmacy

Time to make a move

Workers are in a prime position to make a career-changing move, but the clock is ticking.

Workers have been in a unique position of power recently — one that they likely won’t hold for much longer. So, if you want to make a move to get a promotion, a raise, or simply to try something new, now is the time to do it.

Consider the economic picture: There are more job openings than people seeking work, workers are still quitting in record numbers, and wages are rising. Employers need workers, which gives workers leverage.

If you lived through the Great Recession, you know just how odd this can feel. People won’t take these jobs, which are mostly concentrated in the service industries. And they’re not just sitting at home, either — many, if not most, have moved on to better positions in other industries, and others started their own businesses. This is why the unemployment rate is still low, and why 2021 saw a record number of new business formations.

I’ve heard this first hand, too. Last summer, I had lunch at one of my favorite Seattle restaurants, El Chupacabra, and chatted with the manager for a minute. She said that she lost her entire staff during the pandemic — she didn’t fire or lay anyone off, they all found other jobs in different industries, and she was happy for them. It did make it difficult to replace everyone, of course, which she was still in the process of doing. Even in a city like Seattle, where the minimum wage is more than $16 per hour (and many service workers earn tips, too), she couldn’t fill her staffing needs.

So, yes, workers have had some leverage for a little bit. But the pendulum swings back, and that leverage is likely going to slip away as the economy slows and contracts.

With that in mind, now is the time to make a move. To find a better-paying job. To job-hop your way to promotion. We may not see another economic situation like this in our lifetimes. So start applying, tapping your networks, and see if you can get another offer. Although many people don’t think of it as such, a job is a business transaction, and workers are in the business of selling their labor. You should get as much as you can for it, and remember that most employers (not all, of course) will think nothing of cutting you loose the second it makes financial sense.

That said, it’s also worth taking a look at how the current situation came about. Here’s what Barry Ritholtz of Ritholtz Wealth Management had to say about it in a recent blog post, which I largely agree with:

“There are now two job openings for every unemployed person, the number of participants not in the labor force continues to grow, and the lack of workers is being blamed for everything from supply chain issues to inflation,” he writes. He says that there are two things we can do to “improve the labor market and benefit all parties,” but that they’d require action from both Congress and the White House:

Restore immigration to 1995 levels

Make the federal minimum wage adjust automatically

Ritholtz writes:

“The current turmoil in the labor markets did not spring out of anywhere – it is the result of a concerted and successful lobbying effort to prevent the minimum wage from rising. Wages in the bottom quartile have lagged every relevant factor for decades: Inflation, corporate profits, productivity, and C-Suite compensation.”

He continues:

“It should come as no surprise that given an opportunity to better than themselves, an entire generation of workers did so, taking full advantage to exit the bottom of the labor pool. Labor markets are experiencing a generational reset: after decades of lagging wages, the spasmodic readjustment is now better reflecting the dynamics between capital and labor, between employers and employees.”

Obviously, this is a complicated topic, and there’s more to it than this. But the fact is, people have been underpaid for decades, all while more and more wealth has been generated and concentrated among a select few. And despite tax break after tax break, the wealth never trickled down, as promised.

What does this all mean for the average American worker? That the tide finally shifted, and that the wind is at your back. But it’ll change again, and probably soon. If you want to earn more, or otherwise do some career course correction, now is the time to do it.

Don’t wait.

Numbers, Links, and Faces

95%: The percent of jobs lost during the pandemic that have since been recovered, leaving us with an unemployment rate of 3.6%. (Bureau of Labor Statistics)

-20%: The fall in the U.S. birthrate compared to 2007. (Econofact)

80-1: The pre-race odds of winning the Kentucky Derby for Rich Strike, the horse that indeed ended up winning. (ESPN)

Spooky stuff: The number of job candidates “ghosting” employers, meaning that they accept a position and then don’t show up to start it, is at a record high. (The Wall Street Journal)

Life sentence: This guy set the world record for the longest career with one company, having worked for a Brazilian textile company for almost 85 years. (Guinness World Records)

Frowny Face: Workers earning the federal minimum wage of $7.25 are effectively earning 17% less compared to 2009, thanks to 13 years of inflation. (The Balance)

Smiley Face: Oslo is figuring out how to curb its emissions, and hopefully creating a model for other cities to do the same. (The New Yorker)